Equity Overview

Markets rip, bond yields dip, and the Fed finally makes a dovish flip.

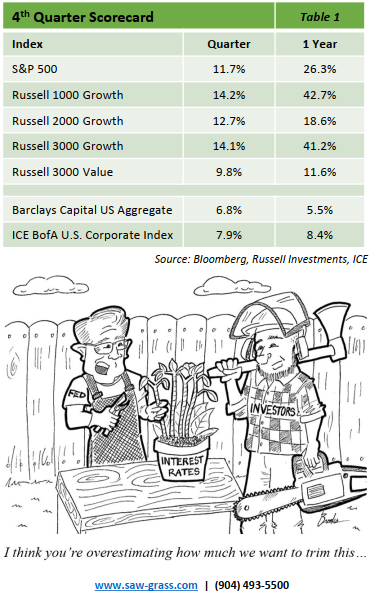

US stocks surged to the edge of all-time highs on easing financial conditions backed by dovish Fed speak. The S&P 500 was up 11.7% in Q4 despite starting the quarter with a -2.1% decline in October. Reversals in both treasury yields and Fed language regarding the timing of rate cuts helped kickstart a nine-week rally of consecutive gains in November. The rally pushed the S&P to a 26.3% return for the year with the index finishing within a 0.5% of its record high. The strongest quarter of performance for the year was also the broadest. Both the cyclically-oriented Dow Jones Index and the tech-heavy Nasdaq outperformed the S&P and small cap stocks finally outperformed large caps by over 3%.

The market tries to broaden but the Magnificent 7 party keeps going.

After failing to get behind the velvet rope of the Magnificent 7 club for three quarters, the Other 493 stocks decided to have a bullish block party of their own. However, the Magnificent 7 enjoyed the block party as well with all but two stocks in the group registering returns above the S&P’s 11.7%. The resilience of this mega cap tech block continues to call into question the notion of a broadening market after what was an especially narrow 2023. For the year, the median return for stocks in the S&P 500 was 16% less than the aggregate index return – that’s the largest gap since the tech bubble of the late 1990’s.

Disinflation and financial easing give Fed confidence to pivot.

Compounding sources of economic optimism propelled bonds higher in the fourth quarter. Multiple readings of price levels showed the lowest rates of growth since 2021 suggesting that inflation may finally be slowing. Financial conditions eased significantly over the last two months of the year as bonds rallied and treasury yields fell. As a result, messaging from the Fed became notably more dovish culminating with Fed Chair Powell’s December admission that the board has pivoted towards the idea of rate cuts in 2024.

Outlook: Once more with feeling…

Considering that few, if any, market pundits predicted the hefty returns of 2023, perhaps it is more constructive to make observations instead of forecasts. Fed trajectory is much more certain which could be a bullish tailwind for 2024. However, interest rate cuts have not only been widely predicted and confirmed by Fed governors, but they’ve also been priced into the market. Many of the exciting themes of 2023 (think Artificial Intelligence, Obesity drugs) will require companies to show proof that investments can turn into earnings. Speaking of earnings, slowing inflation is good for consumers but reduces pricing power and margin growth for companies. While the magnitude of returns in 2024 may be hard to predict, investors’ willingness to continue paying a premium for last year’s optimism will likely determine the market’s trajectory.

Fixed Income Overview

A November to Remember

Through October, the bond market was staring at a 3rd consecutive year of negative returns as the momentum of a strong economy continued, leading to a persistent hawkish sentiment in the market. However, a dovish pivot took place in November which led to a huge turnaround and a quarterly return from the Bloomberg Aggregate of +6.8%. This brought the YTD return up from negative territory to a gain of +5.5%. The November return alone of +4.5% was the largest monthly gain since May 1985.

Prior to the pivot, the 10-year Treasury peaked at 4.99% in mid-October. As the idea of a soft landing in 2024 became more realistic, the market started to price in further rate cuts, eventually getting to the point of pricing in six rate cuts for the upcoming year. This differs from the Fed’s current view on rate movements, which has three forecasted cuts for 2024. The Treasury market rallied in accordance with this mindset and the 10- Year ended the year over 100bps lower than its peak, at 3.88%. For the quarter, most of the Treasury curve rallied with the 2-Year down 79bps and 30-Year down 67bps.

In line with the substantial rally in most risk assets during the quarter, corporate bond spreads tightened by 21bps, with much of the movement occurring in November and December. This brings corporate bond spreads back to levels not seen since the early stages for the Fed tightening cycle in 2022.

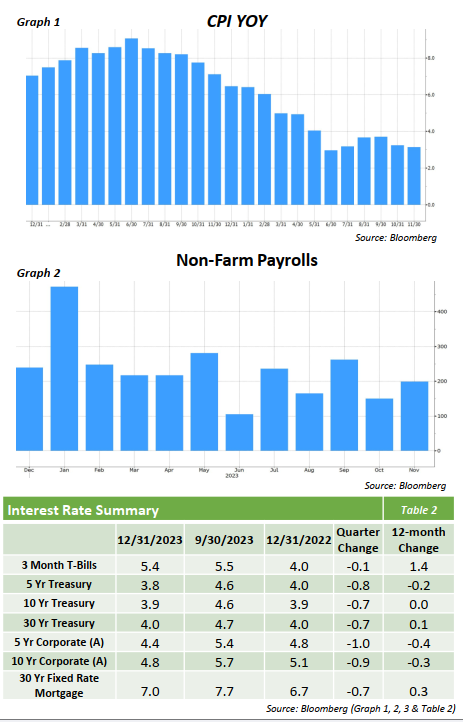

The premise of a soft landing implies that the substantial monetary policy tools used by the Fed were successful, completing their goal of driving down inflation and keeping the economy afloat. Recent indicators look positive on the inflation front as CPI YOY was 3.1% in November, down significantly from its peak of 9.1% in June (chart 1). The labor market has also remained strong, gaining over 225k jobs each month on average (chart 2) and estimates of U.S. GDP growth are around 2.5%.

2023 was a year of unpredictability and 2024 should be no different. Many risks remain that could derail the recent outlook of a soft landing, including geopolitical risks and policy errors leading to a recession and/or higher inflation. However, with the rise of interest rates over the last 2 years, fixed income established itself as an attractive asset class on a stand-alone basis for the first time in a while. And the appeal of the asset class was vindicated with the returns seen in the 4th quarter. While yields are down from their peaks, they remain high relative to recent years and many opportunities still exist to earn solid returns in a high-quality bond portfolio.

Opinions expressed herein are subject to change.