Stocks follow a narrow path of growth to broad market gains.

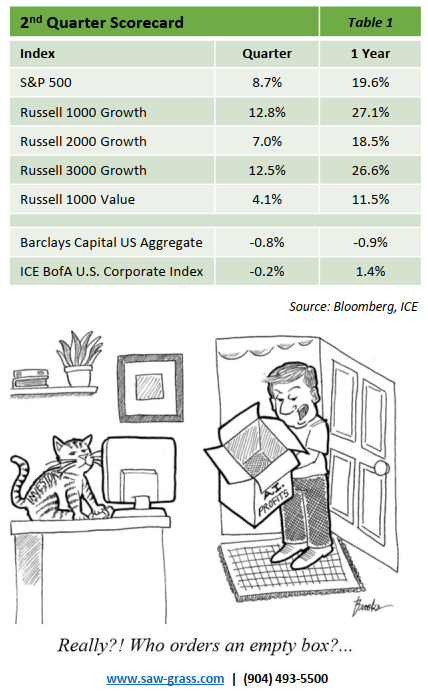

The S&P 500 gained over 7% for the third quarter in a row (+9% in Q2) on advances in AI stocks and an eventual pause in Fed rate hikes. The markets started off with benign gains in April and May as investors pondered the structural integrity of banks and politicians’ ability to work together on a debt-ceiling resolution. As those issues were resolved, investors turned their focus to supporting big-cap tech names in June, driving the market to its highest monthly return for the year. Growth-oriented stocks vastly outperformed their value-centric counterparts (13% vs. 4%), while a strong June rally helped small caps nearly catch large caps with a 7% gain.

Generative A.I. generates investor optimism and the majority of S&P 500 returns.

The proliferation of artificial intelligence has been predicted to have as large an impact as the Industrial Revolution. In the 2nd quarter, A.I.’s largest impact was propelling tech stocks increasingly further away from their 2022 lows. Unlike the forecasted wide-reaching potential for A.I., the impact on stock returns was not very broad. The seven largest stocks in the S&P 500 averaged 26% returns for the quarter; the other 493 only gained 3%. Alongside Tech, double-digit gains in Consumer Discretionary and Communication Services stocks rounded out the great sector reversal of 2023. The average return for all other sectors was a pedestrian 2%.

Everyone met expectations: the Fed, the banks, the government, and earnings.

Positive resolution of lingering uncertainties provided the foundation for positive investor sentiment. After a lengthy 10-meeting rate-hiking campaign, the Fed finally delivered a long-awaited pause. Regional banks seemed to have found their footing, and the large financial institutions all passed the latest Fed stress test. Negotiations over the debt ceiling sailed through their usual partisan drama and landed in principle a week before the looming default deadline. Q1 earnings, though still negative, easily exceeded expectations with upbeat commentary on waning inflation, realized cost-cutting efficiencies, and of course, A.I.

Outlook Concentration should cause consternation.

The concentration of market gains is a lingering issue that has yet to be settled, and there are only two methods of resolution: the magnificent 7 stocks fall back down to earth, or the market broadens, and the other 493 companies lead the market higher. For the latter scenario to happen, the other 493 will have the challenge of growing earnings in an environment where a less accommodative Fed is committed to slowing inflation at all costs. In either of the scenarios, investors will likely look to take profits when they can after such a strong first half which could make market gains a much more volatile endeavor for the next six months.

Hawkish Sentiment Returns

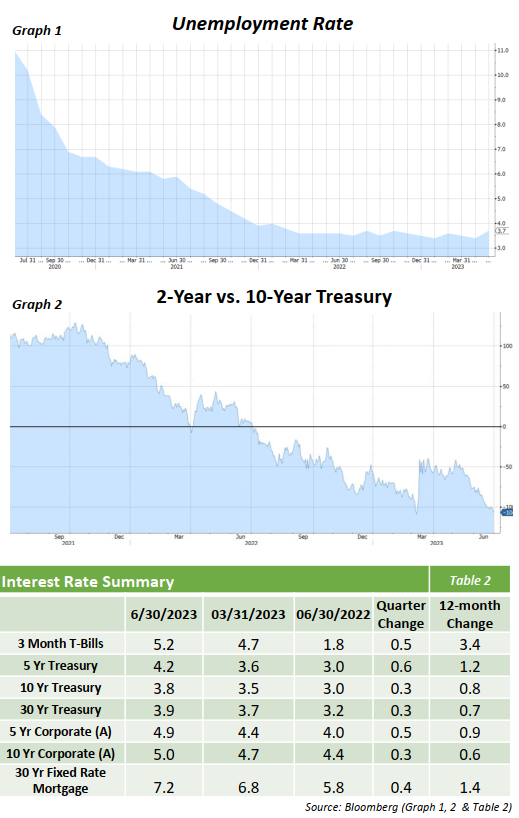

Despite a quarter that included the Federal Reserve’s first rate pause since March 2022, a resilient economy fostered a more hawkish tone, which was reflected in the bond market. Interest rates drove higher across the U.S. Treasury Curve, which was the primary driver for the -0.84% return in the Bloomberg Aggregate for the quarter.

The labor market continued to exceed expectations, beating consensus each month, and the unemployment rate continued to hover below 4% (graph 1). Inflation, as measured by the consumer price index, has continued to moderate from its peak of 9% a year ago. However, at 4% YOY, it is still currently above what the Fed would prefer as services remain particularly sticky.

While interest rates were up across the entire U.S. Treasury curve, the move was more pronounced in the front end, with the 2-Year up 87bps while the 10-Year was up 37bps. This caused a further inversion of the curve as the negative spread between the 2-Year, and 10-Year increased from 56bps to 106bps over the quarter (Graph 2). Beginning in May, the spread between 2/10s widened out for 8 consecutive weeks. The inversion continues to send warning signals of an upcoming recession, despite the persistence of strong economic data contradicting this idea.

The warning signals were somewhat ignored by the corporate bond market as corporate bond spreads tightened by 15bps. Attractive yields, and a sigh of relief after the debt ceiling agreement in early June, were some of the factors contributing to the ongoing demand for corporate bonds. Dissipating fears over the regional banking system also played a part in the solid performance as the US Banking Index tightened by 25bps over the quarter, recovering from its underperformance in Q1.

The continuation of rising interest rates has presented attractive opportunities in the fixed-income space. Investment grade bonds, including U.S. Treasuries, are now offering yields that have not been since before the Great Financial Crisis of 2008. While the Federal Reserve is expected to hike one or two more times, it does appear as if their most recent tightening cycle is nearing its end. Despite this expectation, the path of rates remains uncertain as the soft landing hoped for by the Fed will be difficult to pull off. Our belief is that, given the risks that still remain, the importance of a high-quality bond portfolio is as important as ever.

Opinions expressed herein are subject to change.