Equity Overview

Goldilocks market conditions are bad for bears and just right for bulls.

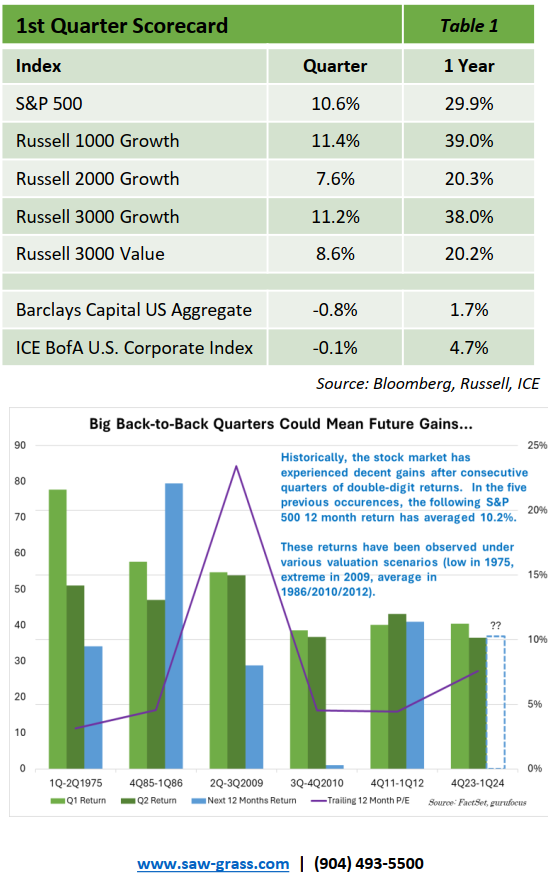

Once upon a time, in a post-Covid market far, far away, investors used to worry about an impending recession and looming bear market. Instead, returns observed in the first quarter of 2024 have given investors from all corners of the market a fairytale-like happy ending. The S&P 500’s nearly 11% gain marked the second consecutive quarter of double-digit returns for the market. The combination of resilient economic data and upbeat corporate guidance helped lift stocks to record highs for the first time since January 2022. Large cap stocks continued to lead the market vastly outperforming small caps (Russell 2000 +5%) and just besting a respectable 10% showing from mid caps. The momentum factor was exceptionally strong in Q1 as the qualifying subset of stocks returned over 22%.

Mega caps drive returns; other sectors ride along but tech stocks still sitting shotgun.

The notion that market participation would eventually broaden has finally come to pass…somewhat. In the previous quarter, nine of the ten largest contributors to return were tech-related stocks. The top ten contributors in the most recent quarter included representation from a much more diverse set of industries such as energy, banks, insurance, and healthcare. However, the size effect continues to dominate market performance as the largest representatives of these industries accounted for most of each sector’s gains. Additionally, despite more diverse participation among the top ten, the five tech stocks in that list (NVIDIA, Microsoft, the tech-like Meta, Broadcom, and Alphabet) still accounted for 45% of the S&P 500 return.

Fed’s dovish stance and economic strength prove stickier than inflation.

Investors have been increasingly excited about the potential for the Federal Reserve to pull off the ‘Goldilocks’ scenario of encouraging economic growth while slowing down inflation. Under this narrative, the Fed was able to reprice haughty expectations for the timing and quantity of rate cuts without any negative effects. February was the strongest month of the quarter despite Fed Chair Powell suggesting inflation is still too persistent to expect rate cuts as early as March. Perhaps the persistence of Fedspeak has given investors enough material to always find the silver lining among the mixed economic reports seen during the quarter.

Outlook: Yearning for earnings.

The past few months has seen the market influenced by lots of initials such as GDP, CPI, AI, and GLP-1. However, the most important set of initials has always been EPS, representing earnings per share. Q4 earnings surprised to the upside and continuance of this trend will be the foundation for the next legs of market momentum. At some point though, momentum has to be justified by fundamentals. Corporate profits seem to be in recovery mode with tailwinds from AI/cloud buildouts and infrastructure growth. Lingering inflation and Fed policy surprises could certainly cause repricing of earnings expectations but the path of least resistance for the market appears to be higher.

Fixed Income Overview

Reversal of Fortune

It was expected to be a challenge for the bond market to repeat the historic performance from the 4th quarter of 2023, and that proved to be the case as the Bloomberg Aggregate posted a return of -0.78% in the 1st quarter. The dovish pivot from the Federal Reserve that was seen in prior months, and subsequent market reaction of rates coming down, was overdone and interest rates rose in the 1st quarter as a result.

Interest rates were up across the Treasury curve with the 2-year up 33bps and the 30-year up 36bps. Much of the rise in rates was due to the re-pricing of expected cuts from the Fed. At the end of the year, the market was pricing in an 85% chance of a rate cut in March. This pricing decreased throughout the quarter as strong inflation and economic numbers continued to be posted, and eventually the Fed decided to hold rates steady at their March meeting. Eyes then turned to the June Fed meeting, in which the market is currently pricing in a 63% chance of a cut.

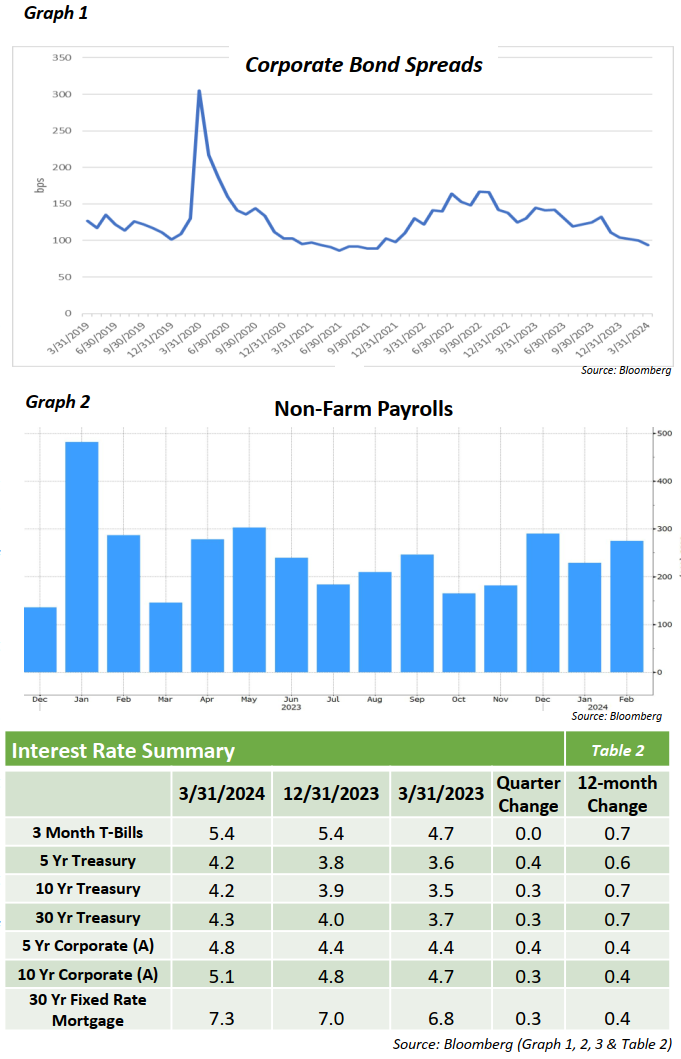

Given the strong economic numbers and higher-yielding environment, investors continued to invest in corporate bonds. Inflows into corporate bonds have exceeded $23bn so far in 2024, with a majority flowing into investment grade bonds. This caused further tightening of the asset class with spreads closing the quarter at 93bps (graph 1), a level not seen since the Fed-induced rally in 2021. With overall economic uncertainty and interest rates remaining high, we have concerns about the path of corporate bond spreads. The ability of companies, especially those of lower quality, to service new debt at higher rates will be put to the test and could have a strain on the overall corporate bond market.

Although the Fed did not cut rates in March, they did revise their expected path of interest rates in future years. The 2024 projections of three rate cuts were unchanged but officials did increase the longer-term rate forecast, signifying their reluctance to cut as much over the next few years. This caused a slight movement down in rates towards the end of the quarter.

With continued economic growth, including CPI above 3% and strong jobs numbers (chart 2), interest rates have been tethered at higher levels. While the Fed is still forecasting three cuts in 2024, these dovish moves have continued to be pushed back and it remains difficult to pinpoint when the start of rate cuts will be. The fixed income asset class remains a very strong investment opportunity, with high yields and potential movement down in rates, but the path to positive returns is not always linear. And this was proven in the 1st quarter. Given the uncertainty, we believe that a high-quality portfolio will serve the best interest of investors, properly balancing attractive returns with appropriate risk controls.

Opinions expressed herein are subject to change.