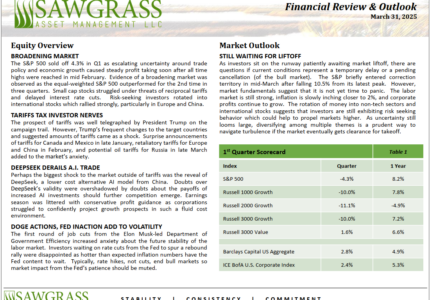

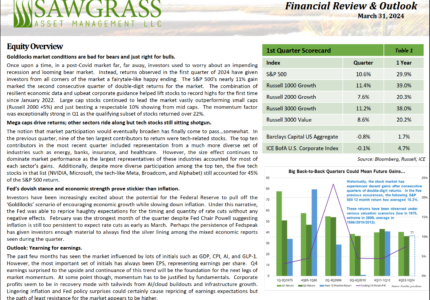

Escalating uncertainty around trade policy and economic growth, amongst other factors, led to a risk-off environment throughout the 1st quarter. The S&P 500 sold off -4.3%, retreating substantially after reaching all-time...

Fixed Income

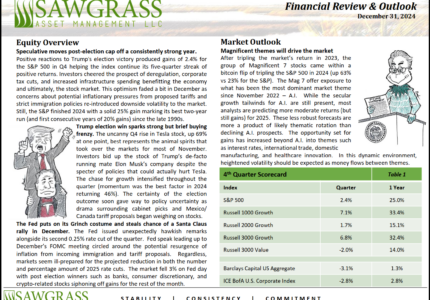

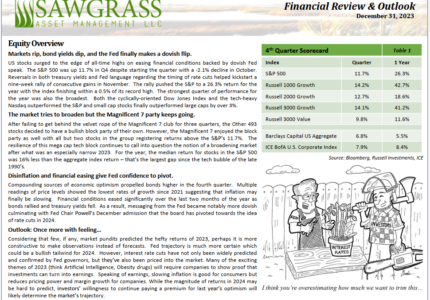

The equity markets rallied post-election on the prospects of deregulation, corporate tax cuts, and increased infrastructure spending. This optimism faded a bit in December as concerns about potential inflationary pressures...

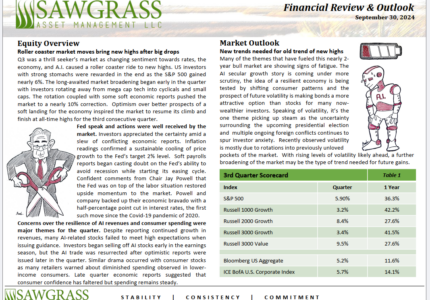

The 3rd quarter was a thrill seeker’s market as changing sentiment towards interest rates, the economy, and A.I. caused a roller coaster ride in the markets. Investors with strong stomachs were...

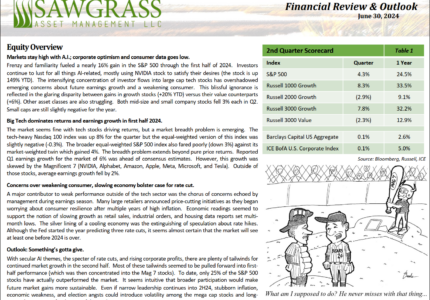

The 2nd quarter saw another strong equity market, but one that continued to show disparities between growth/value and large/small stocks. The fixed income market was choppy while still trying to...

Underlying factors are continuing to show signs of a change in leadership within the equity markets. In his latest white paper titled “FROM GIANTS TO GEMS: ANTICIPATING THE SMALL CAP...

Mega-caps drove the equity market in the 1st quarter, albeit with some signs of divergence, and bonds slightly reverted from the record-setting performance seen in the previous quarter. David Siegel,...

Amidst a dovish pivot from the Fed, both equity and bond markets surged in the 4th quarter. The Sawgrass team recaps the historic quarter with some insight on the factors...

It is important to properly analyze the role of risk when conducting performance analysis. In this presentation, Portfolio Manager Anthony Brooks explains how using Alpha as a measurement tool to...

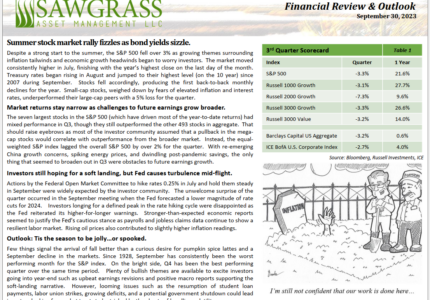

Coming off a hot summer, the markets began to cool as we entered the Fall season. With reignited fears of inflation and rising interest rates, the 3rd quarter saw sell-offs...

The opportunities in Fixed Income are more abundant than they have been in over a decade. Portfolio Manager David Siegel, CFA, gives his thoughts on why we believe investment grade...