The opportunities in Fixed Income are more abundant than they have been in over a decade. Portfolio Manager David Siegel, CFA, gives his thoughts on why we believe investment grade...

By Sawgrass Asset Management

The Sawgrass Investment Team hosted a Lunch & Learn Session at the June 2023 Florida Public Pension Trustee Association (FPPTA) Conference in Orlando. The team shared their current market perspectives...

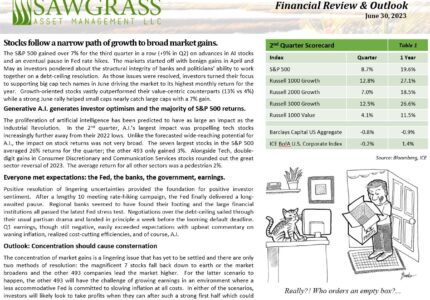

The 2nd quarter saw a top-heavy equity market rally driven by large-cap tech names, and a bond market that returned to its hawkish ways. The Sawgrass team recaps the quarter...

Liridon Gila, CFA, Co-CIO of Sawgrass Asset Management, LLC, recently sat down with EisnerAmper and offered his outlook for investing in growth equity and fixed-income markets. He touches on the...

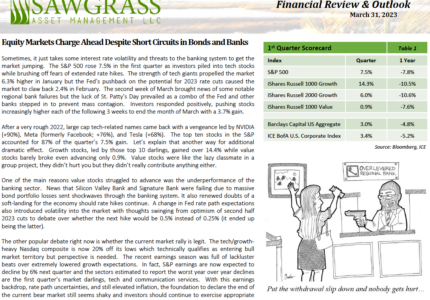

The 1st quarter saw solid returns across many assets classes but not without a flurry of developments along the way and elevated volatility under the surface. The Sawgrass team recaps...

We have had some extremely exciting developments at Sawgrass Asset Management and, as we celebrate our 25th year anniversary as a firm, are proud of the path we are on...

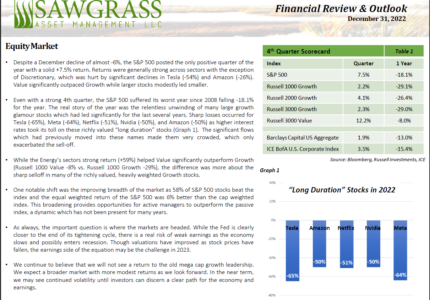

The 4th quarter capped off one of the most tumultuous years of market performance in history. The Sawgrass team recaps the quarter and what may be expected heading into 2023....

The recent spike in interest rates has had an impact across many areas, no more so than the effect it has had on the technology sector. Liridon Gila, CFA, explains...

The long-standing theory has been that high reward compensates for high risk. However, as the path of markets are never linear and include periods of volatility, low-beta stocks can tend...

Don’t fight the Fed…again. In recapping the performance of equity and bond markets in the 3rd quarter, David Siegel, CFA discusses how this mantra can be viewed in a different...