The 4th quarter capped off one of the most tumultuous years of market performance in history. The Sawgrass team recaps the quarter and what may be expected heading into 2023.

Equity Market

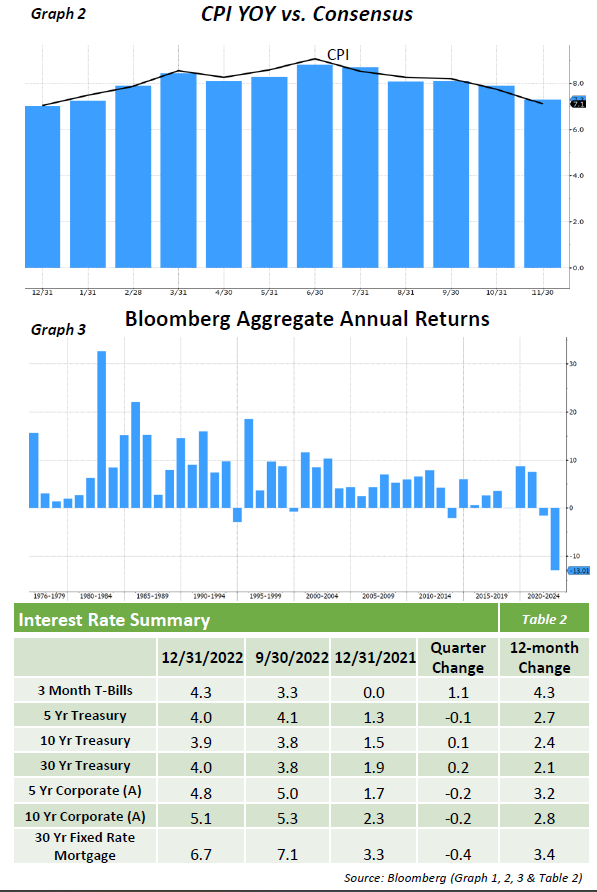

- Despite a December decline of almost -6% the S&P 500 posted the only positive quarter of the year with a solid 7.5% return Returns were generally strong across sectors with the exception of Discretionary, which was hurt by significant declines in Tesla (-54%) and Amazon (-26%) Value significantly outpaced Growth while larger stocks modestly led smaller.

- Even with a strong 4th quarter, the S&P 500 suffered its worst year since 2008 falling -18.1% for the year The real story of the year was the relentless unwinding of many large growth glamour stocks which had led significantly for the last several years Sharp losses occurred for Tesla (-65%) Meta (-64%) Netflix (-51%) Nvidia (-50%) and Amazon (-50%) as higher interest rates took its toll on these richly valued “long duration” stocks (Graph 1 The significant flows which had previously moved into these names made them very crowded, which only exacerbated the sell off.

- While the Energy’s sectors strong return (+59%) helped Value significantly outperform Growth (Russell 1000 Value -8% vs Russell 1000 Growth -29% the difference was more about the sharp selloff in many of the richly valued, heavily weighted Growth stocks.

- One notable shift was the improving breadth of the market as 58% of S&P 500 stocks beat the index and the equal weighted return of the S&P 500 was 6% better than the cap weighted index This broadening provides opportunities for active managers to outperform the passive index, a dynamic which has not been present for many years.

- As always, the important question is where the markets are headed While the Fed is clearly closer to the end of its tightening cycle, there is a real risk of weak earnings as the economy slows and possibly enters recession Though valuations have improved as stock prices have fallen, the earnings side of the equation may be the challenge in 2023.

- We continue to believe that we will not see a return to the old mega cap growth leadership. We expect a broader market with more modest returns as we look forward In the near term, we may see continued volatility until investors can discern a clear path for the economy and earnings.

Fixed Income Market

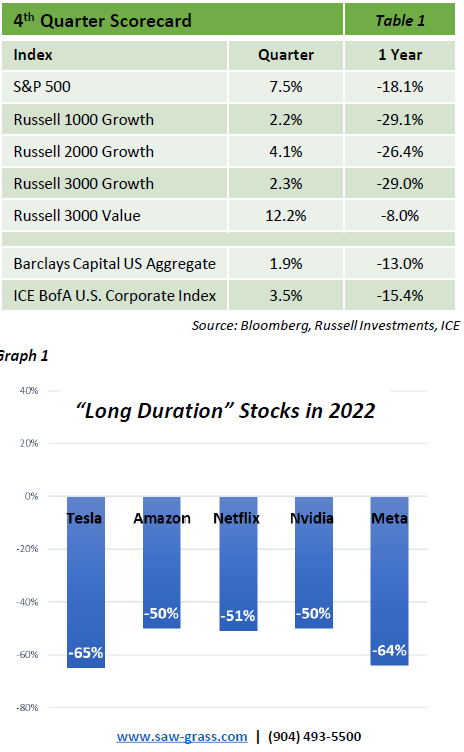

- While inflation remains elevated, the pace is showing signs of slowing down CPI moderated from levels above 9% in June down to 7.1% in November, below consensus expectations (Graph 2 This slowdown allowed the Fed to ease up on the pace of rate hikes, raising rates by 50bps in December after four consecutive 75bp hikes.

- The less hawkish sentiment being expressed by the Fed allowed U S Treasury yields to show signs of stabilization The 10 Year U S Treasury was up slightly for the

quarter, ending the year at 3.88% This rate was still up a staggering 237bps for the year. - Despite ongoing economic concerns, corporate bonds have continued to show resilience Positive credit fundamentals and attractive yields help to buoy the asset

class, as capital has begun to flow into investment grade bonds For the quarter, investment grade bond spreads tightened by 29bps, a reversal of the prior three

quarters which each had seen spreads widen. - The stabilization in rates and tightening of corporate bond spreads were a welcome relief for bond performance Each of the previous quarters of 2022 had generated

negative performance, leading to the worst 9-month period in the history of the Bloomberg Aggregate Fortunately, the 4th quarter was able to balance some of those losses with a positive return of +1.9%. However, even with this quarterly return, the AGG was still down -13% for the year, making it the worst annual performance on record (Graph 3). - Even with a slower speed of rate hikes, the Fed has maintained their conviction in keeping inflation under control In order for this stretch of rate hikes to stop, a longer trend of moderating inflation will have to appear In the meantime, a struggling economy and higher interest rates can be a recipe for increased volatility

in the markets. - Fortunately, given the current level of interest rates, the bond market currently offers opportunities that can offer attractive risk/reward scenarios not seen in a while As we enter 2023 we see more upside in bond market returns but plenty of risks still remain and our emphasis on high quality will remain in place.

Opinions expressed herein are subject to change.