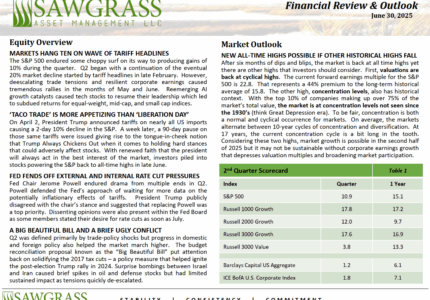

Trade policy disruptions and Fed policy responses created a backdrop of sharp volatility followed by a swift and powerful market rebound in Q2. Surging interest in tech and AI along...

By Sawgrass Asset Management

The Sawgrass Investment Team hosted a Lunch & Learn Session at the June 2025 Florida Public Pension Trustee Association (FPPTA) Conference in Orlando. The team shared their perspectives on “Trade...

The ability to be nimble is an extremely important attribute within active fixed income asset management. In the paper titled “Less is More: The Advantages of Small and Mid-Sized Fixed...

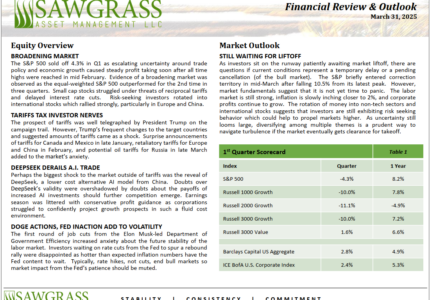

Market Review • The Russell 2000 Growth (R2G) lost -11.1% for the quarter. Uncertainty surrounding tariffs, persistent inflation, recession worries that accompany those items, as well as declining consumer confidence...

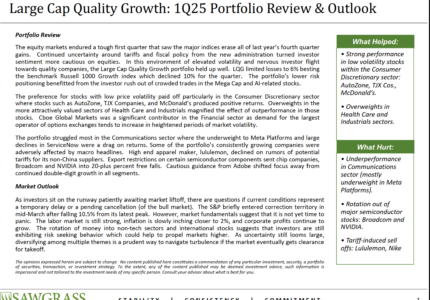

Portfolio Review The equity markets endured a tough first quarter that saw the major indices erase all of last year’s fourth quarter gains. Continued uncertainty around tariffs and fiscal policy...

Escalating uncertainty around trade policy and economic growth, amongst other factors, led to a risk-off environment throughout the 1st quarter. The S&P 500 sold off -4.3%, retreating substantially after reaching all-time...

Traditional equity valuation metrics, while helpful, also can have limitations. Within his most recent white paper, Liridon Gila, CFA, introduces the Quality Adjusted Valuation Ration (QVR), to include many of...

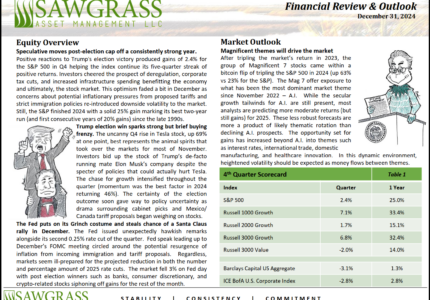

The equity markets rallied post-election on the prospects of deregulation, corporate tax cuts, and increased infrastructure spending. This optimism faded a bit in December as concerns about potential inflationary pressures...

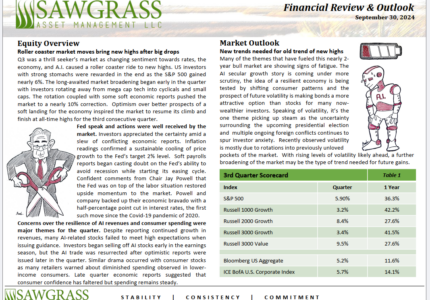

The 3rd quarter was a thrill seeker’s market as changing sentiment towards interest rates, the economy, and A.I. caused a roller coaster ride in the markets. Investors with strong stomachs were...

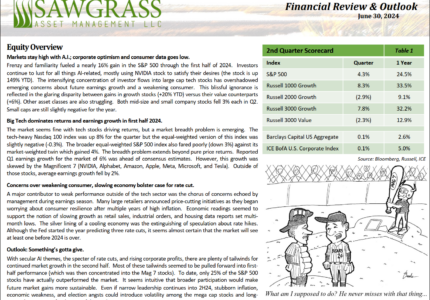

The 2nd quarter saw another strong equity market, but one that continued to show disparities between growth/value and large/small stocks. The fixed income market was choppy while still trying to...