The 4th quarter wrapped up a solid year of gains in both the equity and bond markets. However, questions surrounding the agility of the economy, stability of the Fed and AI spending did lead to additional volatility. In this quarter’s market review and outlook, Anthony Brooks and David Siegel, CFA, discuss how investors appear to have a renewed focus on the importance of fundamentals and how that trend may continue into 2026.

Equity Overview

RESILIENT ECONOMY AND ROSY EARNINGS REWARD INVESTORS

Despite a rocky start to 2025, US stocks rose for the last three quarters to finish the year up 18%. Q4 saw the smallest positive quarterly gain as investors questioned the agility of the economy, the stability of the Fed and the profitability of massive AI spending. Strong earnings and increasing rate cut optimism helped keep momentum intact lifting the market 3% higher for the quarter.

MARKETS WRESTLED WITH RATES BUT DIDN’T GET PINNED DOWN

Stocks grappled with incoming labor and inflation data as investors debated the speed, magnitude and direction of expected rate cuts. As Fed Chair Powell seemed to have rate betting odds in a chokehold, President Trump tagged in a new much more dovish Fed governor while attempting to throw other hawkish governors over the ropes. Investors ultimately emerged with the championship belt as the Fed eventually lowered rates three times during the quarter which helped buoy markets.

INVESTORS QUESTION INTELLLIGENCE OF ARTIFICIAL REVENUES

The 2025 Oxford word of the year was “Rage Bait” but among investors, the word would most likely be “Circularity.” This term describes the questionable revenue deals that AI-related companies announced with other revenue-light companies backed by the same 2-3 megacap entities. Questionable revenue deals coupled with debt-fueled increases in AI spending made the markets ponder the dwindling magnitude (or even possibility) of good returns on investment which led to increased tech volatility.

SOLID EARNINGS GROWTH OVERSHADOWS GEOPOLITICS

New trade tensions with China bubbled up, new military tensions erupted in the Caribbean, New York City even got a new mayor but old acquaintances with earnings were not forgotten. Over 80% of S&P 500 companies reported earnings above expectations with an above-average blended growth rate of 13.6%. While spending plans were scrutinized, multiple sectors benefitted from reporting good results.

Market Outlook

THE TREND IS YOUR FRIEND BUT WATCH WHAT YOU SPEND

Perhaps the most notable observation of 2025 was that earnings growth, rather than multiple expansion, drove the bulk of stock price gains—particularly within the technology sector. While this has coincided with a cooling of the momentum trade, it also reflects increased market preference for fundamentals. If this trend continues into 2026, returns may become more dependent on earnings delivery and balance-sheet strength rather than momentum or macro-driven optimism. Three consecutive years of stellar returns have markets enthusiastic about the future but also trading at historically elevated levels (S&P 500 forward P/E is 22.1 vs. a 10-year average of 18.7), With this backdrop and a potential for renewed focus on fundamentals, 2026 is setup to reward thrifty investors that can find high-quality companies still available at below-average valuations.

Fixed Income Overview

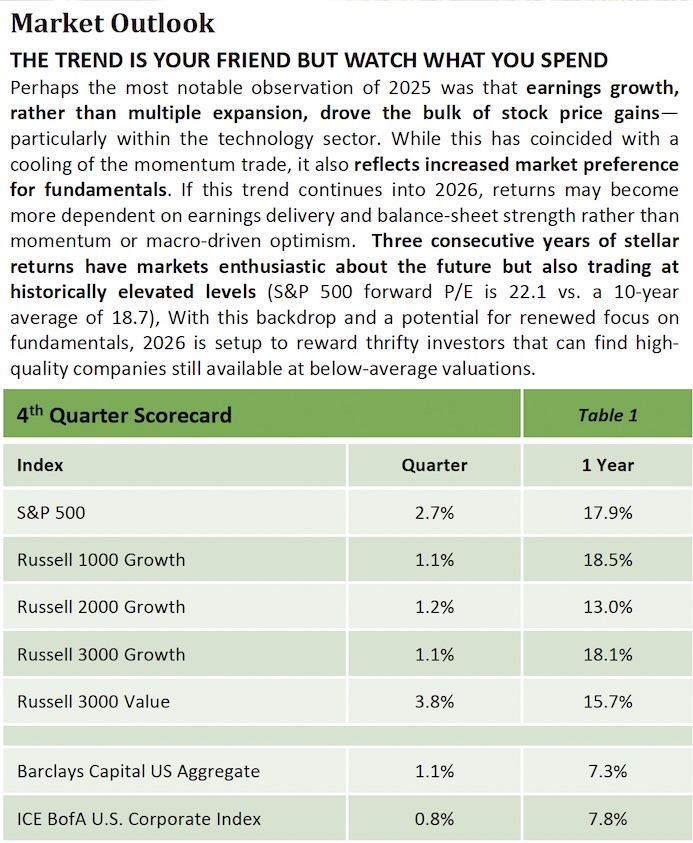

A strong 4th quarter for the Bloomberg Agg, with a return of 1.1%, wrapped up a year of solid gains. The annual return of 7.3% marked the best return since the Covid driven market of 2020.

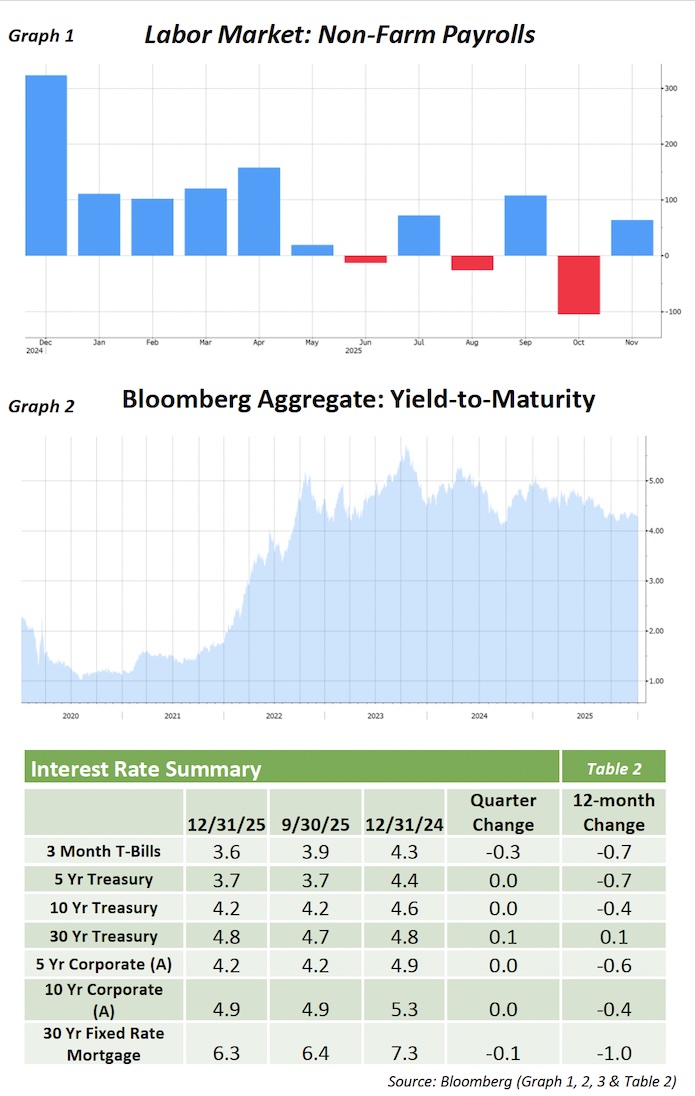

As has been the case for the majority of the year, the debate between inflation concerns and a weakening labor market was the main driver of market movements. The Government shutdown had previously delayed economic releases, specifically those on the labor market, but the delayed announcements came out throughout the 4th quarter. An already shaky job market (Graph 1) was not provided with any reassurances with both October (-105k) and November (+64k) job growth, coupled with an increase in the unemployment rate to 4.6%, only adding to concerns as we head into 2026.

This unease was reflected in the reaction by the Fed, which cut rates by an additional 25bps in December. This was the third rate cut in 2025. While much of the rhetoric from Fed governors indicates that this cut may be the last for now and they would prefer to take a wait-and-see approach, the market is still pricing in two cuts for next year. This dynamic is paired with the upcoming announcement of a new Fed president early in the year. The appointment is coming from an administration that has repeatedly stated their preference for lower rates.

In reaction to the continued rate cuts, the steepening of the Treasury curve continued with front-end rates coming down. For the quarter, the 2-year and 5-year Treasury were down 14bps and 2bps respectively. Conversely, the 30-year Treasury was up 11bps. This mirrored the trend of 2025 as, for the year, the 2-year and 5-year were down 77bps and 66bps while the 30-year was up 6bps.

Corporate bond spreads widened out slightly (3bps) during the quarter. While there was a risk-on sentiment overall in the market, spreads sit at all-time tights and there is not much room for upside in spread compression. Signs of deterioration in the lower quality bond issuers and structures have raised some alarms about the possibility of weakness leaking into the investment grade sector.

Despite a very good year of performance, yields are still at a very attractive point (Graph 2) and there are catalysts that remain to provide further gains. Given the weakness in the labor market and many uncertainties heading into 2026, a strong case can be made for focusing on high-quality assets and for investment grade fixed income to present a solid risk/reward return scenario.

Opinions expressed herein are subject to change.