Equity Overview

Speculative moves post-election cap off a consistently strong year.

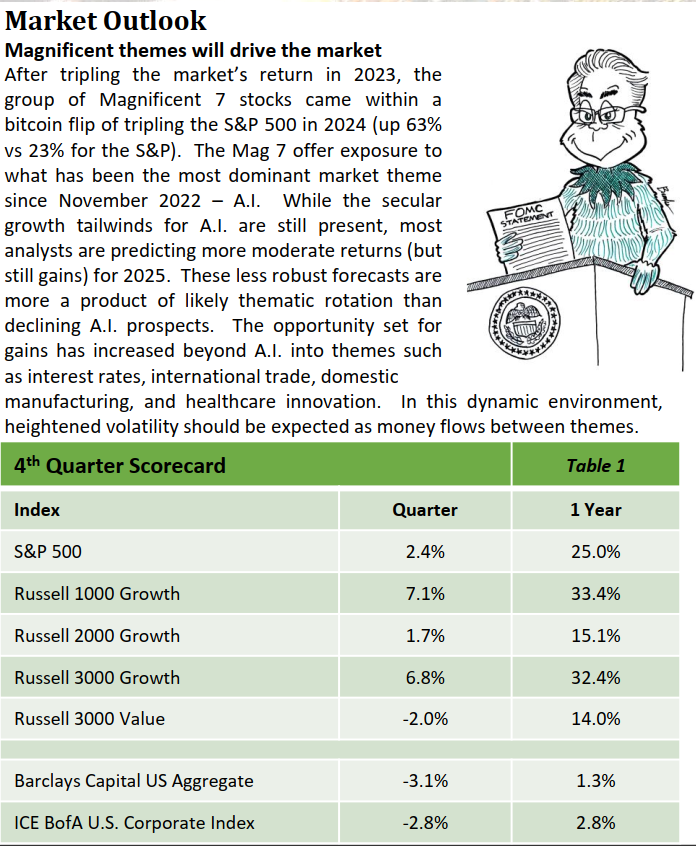

Positive reactions to Trump’s election victory produced gains of 2.4% for the S&P 500 in Q4 helping the index continue its five-quarter streak of positive returns. Investors cheered the prospect of deregulation, corporate tax cuts, and increased infrastructure spending benefitting the economy and ultimately, the stock market. This optimism faded a bit in December as concerns about potential inflationary pressures from proposed tariffs and strict immigration policies re-introduced downside volatility to the market. Still, the S&P finished 2024 with a solid 25% gain marking its best two-year run (and first consecutive years of 20% gains) since the late 1990s.

Trump election win sparks strong but brief buying frenzy.

The uncanny Q4 rise in Tesla stock, up 69 at one point, best represents the animal spirits that took over the markets for most of November.

Investors bid up the stock of Trump’s de-facto running mate Elon Musk’s company despite the specter of policies that could actually hurt Tesla.

The chase for growth intensified throughout the quarter (momentum was the best factor in 2024returning 46%).

The certainty of the election outcome soon gave way to policy uncertainty as drama surrounding cabinet picks and Mexico/Canada tariff proposals began weighing on stocks.

The Fed puts on its Grinch costume and steals chance of a Santa Claus rally in December.

The Fed issued unexpectedly hawkish remarks alongside its second 0.25% rate cut of the quarter.

Fed speak leading up to December’s FOMC meeting circled around the potential resurgence of inflation from incoming immigration and tariff proposals.

Regardless, markets seem ill-prepared for the projected reduction in both the number and percentage amount of 2025 rate cuts.

The market fell 3% on Fed day with post election winners such as banks, consumer discretionary, and crypto-related stocks siphoning off gains for the rest of the month.

Market Outlook

Magnificent themes will drive the market

After tripling the market’s return in 2023, the group of Magnificent 7 stocks came within a bitcoin flip of tripling the S&P 500 in 2024 (up 63% vs 23% for the S&P). The Mag 7 offer exposure to what has been the most dominant market theme since November 2022 – A.I. While the secular growth tailwinds for A.I. are still present, most analysts are predicting more moderate returns (but still gains) for 2025. These less robust forecasts are more a product of likely thematic rotation than declining A.I. prospects. The opportunity set for gains has increased beyond A.I. into themes such as interest rates, international trade, domestic manufacturing, and healthcare innovation. In this dynamic environment, heightened volatility should be expected as money flows between themes..

Fixed Income Overview

Growth Expectations Lead to Sell-Off

As we headed toward the end of 2024, there was still much uncertainty about how certain outcomes would play out with a presidential election and Federal Reserve decisions queued up to play a significant role in determining the direction of markets. The movement throughout the quarter, mainly a sell-off in the Treasury market, contributed to a return of -3.1% from the Bloomberg Aggregate.

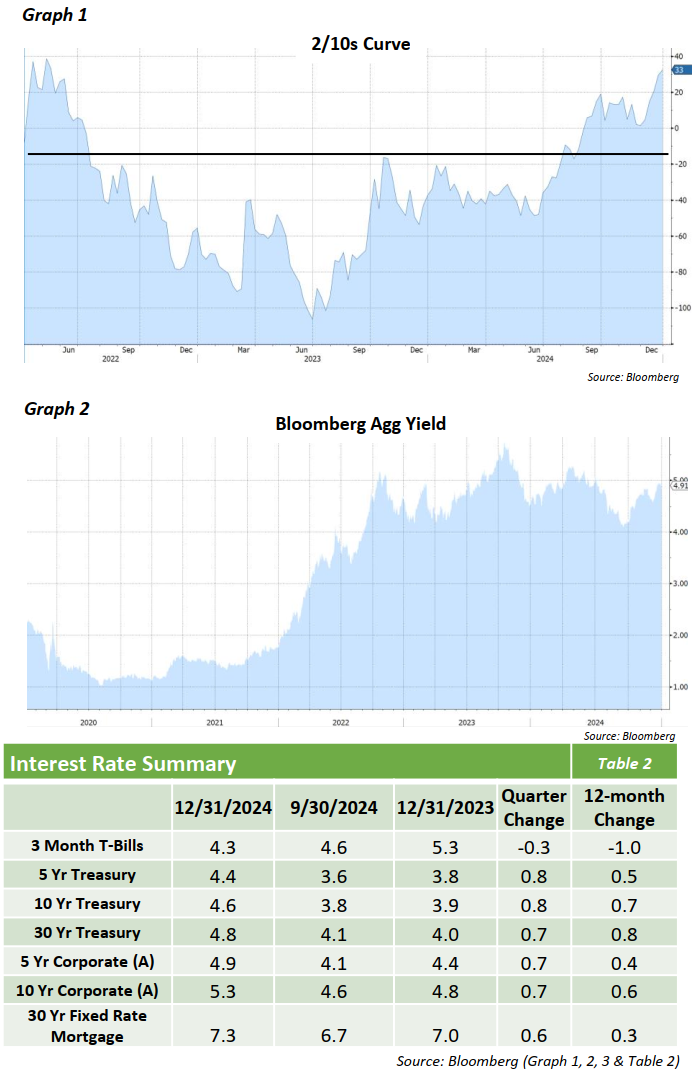

The Republican sweep in November, while causing a positive shift in sentiment for risk assets, also played a part in stoking concerns about growth, inflation and deficits. These concerns led to the sell-off in the U.S. Treasury market with yields up across the main maturity spectrums. The 2-year, 10-year and 30-year Treasuries were up 60bps, 79bps and 66bps respectively. After an inversion in 2/10s that was in place for over 2 years, signs of a sustained steepening were evident and the 2/10s curve ended up at +33bps, the highest since June 2022 (chart 1).

Amidst the sell-off, The Fed held meetings in November and December, cutting the Fed Funds rate by 25bps at each meeting. Despite the 50bps of total cuts, coming on the heels of an additional 50bps of cuts in September, the expectation of future rate cuts shifted dramatically. At the end of Q3, the market was pricing in almost eight rate cuts for 2025. By the end of the quarter, this was revised all the way down to only two cuts.

The projected growth was a positive within risk assets, primarily corporate bond spreads, which tightened by 10bps during the quarter. The asset class continued to outperform let by yield-based demand and receding recession risk. The investment grade index finished 2024 at a spread of only +80bps, hitting tights not seen since 1997.

While the 4th quarter did manage to provide answers some of the questions that the markets had, the ultimate conclusions to those answers are still unknown. New leadership in the government will most certainly lead to changes in various policies including tax reform, immigration, tariffs and regulations. As many of the previous years have taught us, monetary policy and Fed decisions can be very fluid and change dramatically in response to economic outlooks.

Yields remain high with the yield on the Bloomberg Aggregate ending the year at 4.91% (chart 2). Despite the volatility, the yield level, continued demand and economic optimism should present good long-term opportunities within the investment grade fixed income space.

Opinions expressed herein are subject to change.