Equity Overview

MARKET INTEREST PIQUED BY PEAK AI DEALS, PEEK AT RATE CUTS

Optimism over Big Tech AI developments and a dovish turn at the Fed fueled a strong Q3 for the markets. The S&P 500 rose all three months producing an 8.1% gain. Although market concentration remained significant (the equal-weighted S&P lagged its cap-weighted frenemy by 3.3%), smaller stocks became meaningful participants in the market rally. The small cap Russell 2000 index pushed to new highs for the first time since last November on the tailwind of easing monetary policy.

FED DRAMA LIBERATED MARKETS FROM FOCUS ON TARIFFS

Those paying attention to the Federal Reserve in Q3 witnessed more plot twists than a hit reality series. The season-opener of “Dove” Island started with a July FOMC meeting that saw two dissenters to the Fed’s cautiously hawkish lean. The next few episodes included an awkward site visit with President Trump, a Fed governor resignation, and the attempted firing of another governor over fraud allegations. The season ended with the appointment of a very dovish new governor just in time for a 0.25% rate cut announcement in September.

BIG AI DEALS LEAD TO BIG PAYOFFS DESPITE SCRUTINY

AI headlines were also captivating as markets digested unprecedented government deals and increased spending plans for the largest tech companies. Wall Street seemed more interested in the size of the contracts than the fine print, bidding up almost any stock with tangled ties to the AI gold rush. Despite a growing chorus of deal skepticism, AI euphoria eventually proved louder than its critics.

UNSURPRISING NEWS BRINGS UNSURPRISING CALM

The lack of significant trade developments and direction from economic reports helped limit downside volatility in Q3. As expected, trade deals with the EU and Japan were announced (with light details), a 90-day pause on reciprocal China tariffs was renewed, and most industry specific tariffs announced had loopholes that subdued initial fears. Labor market fears were hard to validate as weaker payrolls were offset by falling job claims. Core inflation held steady above 2% but expected tariff impacts grew milder as the quarter progressed.

Market Outlook

SEASONAL TAILWINDS WILL NEED AIRFLOW FROM EARNINGS

As Q4 2025 kicks off, markets are glued to the Fed, trying to guess whether rate cuts will arrive fashionably late—or not at all. Historic seasonality brings multiple tailwinds; markets tend to do well in the fourth quarter and they usually do well in the 12 months following rate cuts that happen near all-time highs. However, stubborn inflation and mixed policy signals (amidst a questionably independent central bank) could awaken the volatility bear that hibernated back in April. Even with all eyes on the Fed, tariffs, and politics, there is still no show bigger than earnings. Fourth quarter earnings have the ability to justify lofty stock prices or drastically reduce valuations. In either case, tech and AI names are likely to garner most of the market’s attention. Q4 is likely to be another market thriller pitting seasonal optimism versus macro drama, with profits playing the spoiler—or the hero.

Fixed Income Overview

All eyes were on the Federal Reserve throughout the 3rd quarter, as questions abound about the potential for rate cuts and about the future composition of the Board. A lack of consensus amongst the existing Fed Governors was very symbolic of the current environment, with dueling concerns about a weakening labor market and higher inflation. The thought of lower rates prevailed for the quarter and fixed income performance followed suit, as the Bloomberg Aggregate was up +2.0%.

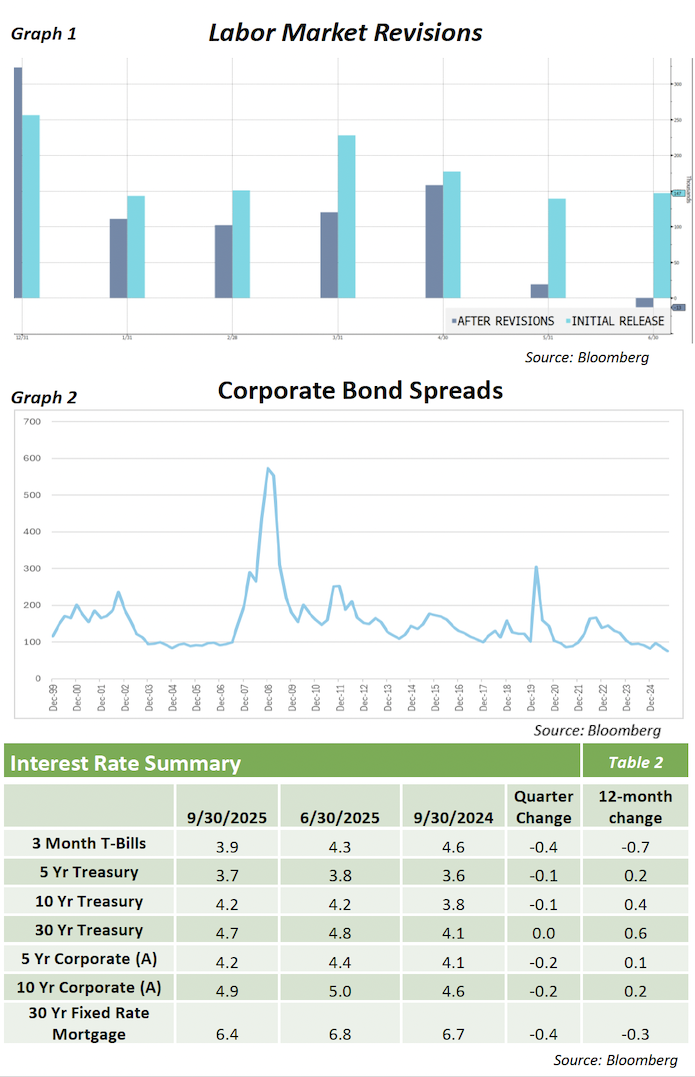

“Revisions” was the most important word in labor market readings during the quarter. Both monthly and annual payrolls numbers were revised significantly downward (graph 1), indicating a job market that was not as strong as previously thought. The annual revision of job growth, from March 2024 to March 2025, showed that the U.S. Labor Market had added 911,000 fewer jobs than initially reported. While corrections are common, the magnitude this time was a bit of an outlier.

In addition to the economic data released, there was a shakeup in the Federal Reserve Board of Governors. Stephen Miran replaced Adriana Kruger in September and President Trump is attempting to fire Fed Governor Lisa Cook. As the President has been extremely vocal about his desire for lower interest rates, these steps could be viewed as a dovish pivot. However, the risk of losing Fed Independence can erode confidence in U.S. assets and have the opposite effect.

Concerns about rising inflation have mostly been led by escalating tariffs and what their eventual impact on prices could be. To this point, inflation has stabilized for the most part with companies willing to eat some of the higher costs. The uncertainty and shifting policies are keeping worries present and the risk remains that inflation can begin to shoot up over the next few quarters. The overall impact on the U.S. Treasury market was for rates to come down slightly. Rates were down by 11bps, 8bps and 4bps respectively across 2-year, 10-year and 30-year maturities.

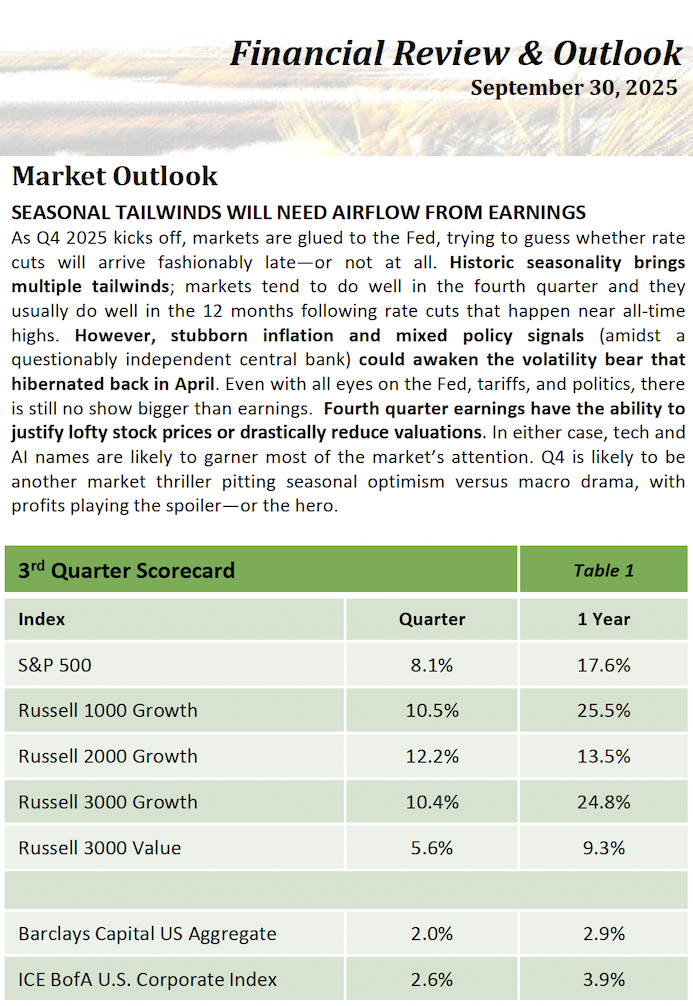

Lower rates and an economy that is holding up well led to a risk-on appetite during the quarter. Investment Grade corporate bond spreads tightened by 10bps. At a spread of 75bps over U.S. Treasuries, corporate bond spreads are at the tightest levels seen this century (graph 2).

The dual mandate of low inflation and high employment will continue to be tested as head into the end of the year. A government shutdown to begin the 4th quarter only serves to muddle upcoming data releases and implementation of policies. While volatility is expected, relatively high yields still present a lot of opportunities within the fixed income space. However, the ability to remain nimble and focus on high-quality issuers will be of extreme importance.

Opinions expressed herein are subject to change.