Equity Markets Charge Ahead Despite Short Circuits in Bonds and Banks

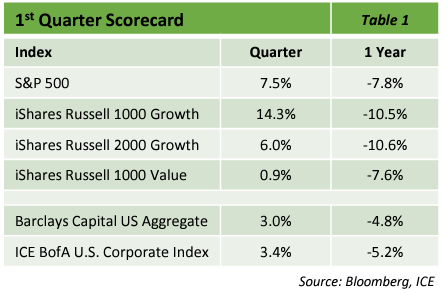

Sometimes, it just takes some interest rate volatility and threats to the banking system to get the

market jumping The S&P 500 rose 7.5% in the first quarter as investors piled into tech stocks

while brushing off fears of extended rate hikes. The strength of tech giants propelled the market

6.3% higher in January but the Fed’s pushback on the potential for 2023 rate cuts caused the

market to claw back 2.4% in February. The second week of March brought news of some notable

regional bank failures but the luck of St. Patty’s Day prevailed as a combo of the Fed and other

banks stepped in to prevent mass contagion Investors responded positively, pushing stocks

increasingly higher each of the following 3 weeks to end the month of March with a 3.7% gain.

After a very rough 2022 large cap tech related names came back with a vengeance led by NVIDIA

(+90%) Meta (formerly Facebook; +76%) and Tesla (+68%). The top ten stocks in the S&P

accounted for (+87%) of the quarter’s 7.5% gain. Let’s explain that another way for additional

dramatic effect Growth stocks, led by those top 10 darlings, gained over 14.4% while value

stocks barely broke even advancing only 0.9%. Value stocks were like the lazy classmate in a

group project, they didn’t hurt you but they didn’t really contribute anything either.

One of the main reasons value stocks struggled to advance was the underperformance of the

banking sector News that Silicon Valley Bank and Signature Bank were failing due to massive

bond portfolio losses sent shockwaves through the banking system It also renewed doubts of a

soft landing for the economy should rate hikes continue A change in Fed rate path expectations

also introduced volatility into the market with thoughts swinging from optimism of second half

2023 cuts to debate over whether the next hike would be 0.5% instead of 0.25%(it ended up

being the latter).

The other popular debate right now is whether the current market rally is legit The tech/growth

heavy Nasdaq composite is now 20% off its lows which technically qualifies as entering bull

market territory but perspective is needed The recent earnings season was full of lackluster

beats over extremely lowered growth expectations In fact, S&P earnings are now expected to

decline by 6% next quarter and the sectors estimated to report the worst year over year declines

are the first quarter’s market darlings, tech and communication services With this earnings

backdrop, rate path uncertainties, and still elevated inflation, the foundation to declare the end of

the current bear market still seems shaky and investors should continue to exercise appropriate

caution in navigating this market.

Fixed Income Markets Continue Volatile Movements

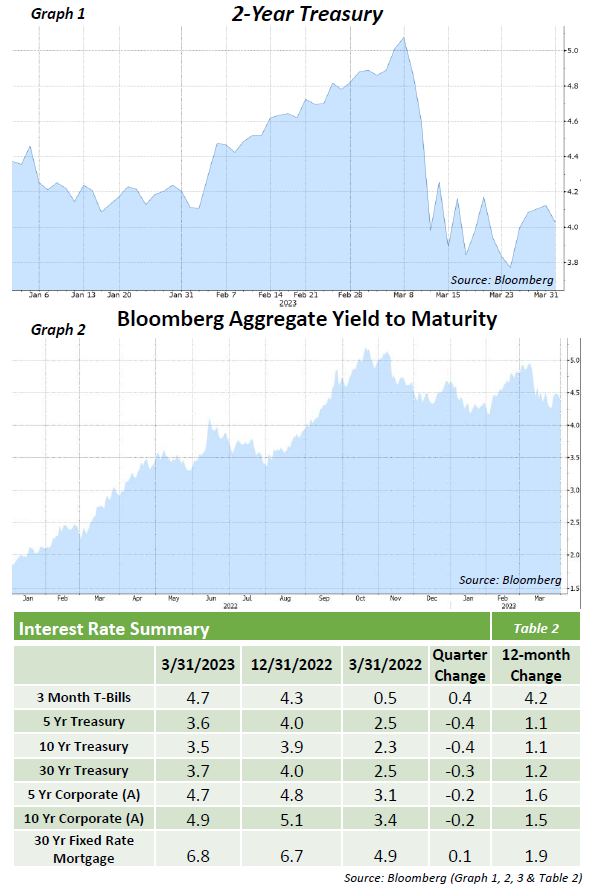

The 1st quarter saw a continuation of the drastic moves in interest rates that have

transpired over the last year and a half, with volatility hitting levels not seen since

2008 The beginning of the quarter was driven by strong labor numbers and sticky

inflation and the front end of the Treasury curve continued its upward trend This

came to a sharp reversal on March 10 th on the announcement of the closure of

Silicon Valley Bank The fears over the banking system and possible contagion

caused parts of the yield curve to come down dramatically, with the 2 Year

exhibiting the largest move down of 85bps (graph 1) over the last 3 weeks In fact,

the 2-year posted seven consecutive days with a yield change of greater than

20bps, both up and down A clear sign of elevated volatility and concern.

The increased volatility in interest rates also had a large impact on the shape of the

yield curve. The hawkish sentiment early in the quarter caused an already inverted

yield curve to become even more exaggerated, with the 2/10s Treasury curve

inversion hitting its largest magnitude since 1981. This continued tightening and

eventual inversion has been a trend over the last 2 years but started to show a

reversal in March and ended the quarter 50 bps steeper from peak inversion on

March 8th.

These concerns caused large dislocations in segments of the corporate bond

market as well. For the quarter, corporate bond spreads widened out by only 7bps

but a majority of this movement occurred after the closure of SVB and other

regional banks. Specifically, the US Banking Index gapped out by 43bps after this

date with regional banks being hit the hardest. The worries about the banking

system caused spreads on some issuers to widen out to levels not seen since the

onset of Covid in 2020 and the subsequent credit crunch.

As rates increased throughout 2022 the yield opportunities on fixed income

products became much more attractive, as evident by the yield on the Bloomberg

Barclays Aggregate peaking above 5% at points (graph 2). With the higher yield

and move down in rates, the AGG was able to deliver a return of 3.0% for the

quarter. This was the 2nd quarter in a row of a positive return and a welcome

sight considering the prior negative returns as the Fed was implementing its

substantial hiking cycle. While steps have been taken to shore up the banking

system, there are still many uncertainties regarding the economy and the path of

rates going forward We believe the importance of a high quality approach is as

important as ever in this environment.

Opinions expressed herein are subject to change.