Portfolio Review

The growth market grinded to a 1.1% gain in the fourth quarter as investors questioned the agility of the economy, the stability of the Fed and the profitability of massive AI spending. Strong earnings and increasing rate cut optimism helped keep enough momentum intact to lift markets higher and close out the third consecutive year of double-digit gains. Our portfolio returned 3.2% for the quarter, outperforming the Russell 1000 Growth Index by 2.1%. The portfolio benefitted from broadening investor demand outside of the Mag 7 and market rotation into more attractively valued sectors.

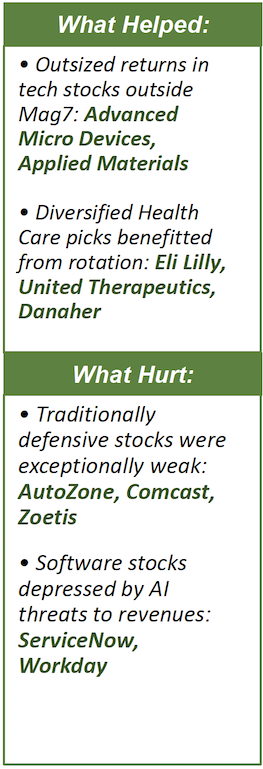

The rotation into the health care sector was broad and the portfolio was well positioned in various industries. Biopharma Eli Lilly, biotech stocks Incyte and United Therapeutics, and life sciences giant Danaher all contributed positively to strong Q4 performance. Gains in chip related stocks also helped the portfolio. As doubts about the circularity of AI revenue deals began to surface, stocks such as Advanced Micro Devices, Broadcom, and Applied Materials avoided the negative sentiment that plagued other AI/chip stocks connected to OpenAI related deals.

While there was rotation away from the recent mega cap market leaders, investors still clamored for higher risk assets. As a result, traditionally defensive sectors did not fare too well in Q4. Within the portfolio, stocks like AutoZone, Comcast, and Zoetis were all punished for having perceived headwinds to already lowered expectations for growth. Poor performance among software stocks, notably ServiceNow and Workday, continued to hamper the portfolio as investors posit that coming AI efficiencies could reduce future subscription volumes.

Market Outlook

Perhaps the most notable observation of 2025 was that earnings growth, rather than multiple expansion, drove the bulk of stock price gains—particularly within the technology sector. While this has coincided with a cooling of the momentum trade, it also reflects increased market preference for fundamentals. If this trend continues into 2026, returns may become more dependent on earnings delivery and balance-sheet strength rather than momentum or macro-driven optimism. Three consecutive years of stellar returns have markets enthusiastic about the future but also trading at historically elevated levels (S&P 500 forward P/E is 22.1 vs. a 10-year average of 18.7), With this backdrop and a potential for renewed focus on fundamentals, the portfolio’s positioning in attractively valued high-quality companies could payoff well in 2026.