Sawgrass Asset Management’s active short-term strategies utilize a disciplined and systematic approach. Our broadly diversified fixed income investing places a premium on high-quality investment grade securities, while simultaneously balancing risk, returns and liquidity for our clients.

Investment Philosophy & Process

We believe that inefficiencies in fixed income markets create opportunities that compensate for active risk. Identifying these opportunities requires a thorough analysis of capital markets, asset fundamentals and technical factors overlaid with a qualitative assessment formed by Sawgrass Asset Management’s extensive experience and judgment. Our approach to portfolio construction takes measured risks and optimizes allocations to investment ideas across alpha sources designed to create strong risk-adjusted returns.

Every element of our fixed income process is tested and designed to add value to our client portfolios. Importantly, we believe that value is not only added by the contribution to enhanced returns but also by controlling risk. Some of the key strategies we employ to achieve these goals are:

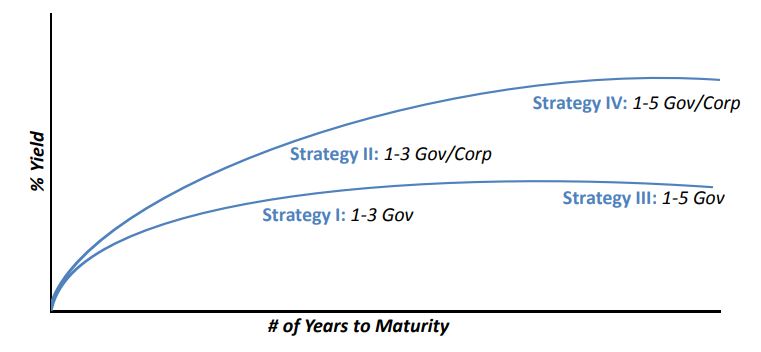

- Managing Portfolio Duration to Reflect our Interest Rate Expectations

- Utilization of Corporate Debt

- Sophisticated Horizon Analysis

- Seeking Best Execution through Technology and Trading Tools