Portfolio Review The growth market grinded to a 1.1% gain in the fourth quarter as investors questioned the agility of the economy, the stability of the Fed and the profitability...

Equity

Market Review The Russell 2000 Growth (R2G) experienced modest gains in 4Q25, delivering a total return of 1.2% amid a broader market environment where small-cap growth stocks showed restrained momentum...

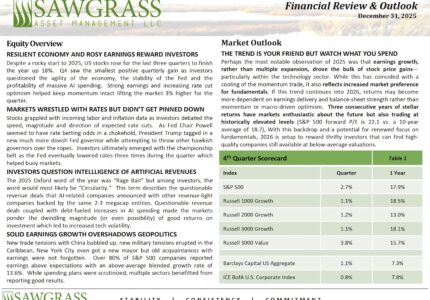

The 4th quarter wrapped up a solid year of gains in both the equity and bond markets. However, questions surrounding the agility of the economy, stability of the Fed and AI...

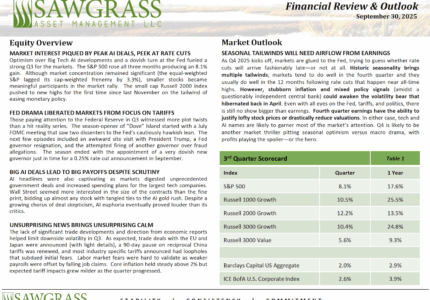

Optimism over Big Tech AI developments and a dovish turn at the Fed fueled a strong Q3 for both the equity and fixed income markets. Potential shakeups at the Fed,...

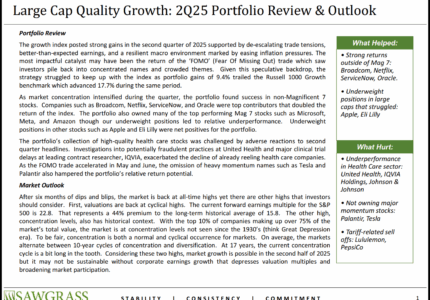

Market Review Small stocks as measured by the Russell 2000 (R2) were up 8.5% in 2Q25 while the S&P 500 (SP5) rose 10.9% in the quarter. This extends large cap...

Portfolio Review The growth index posted strong gains in the second quarter of 2025 supported by de-escalating trade tensions, better-than-expected earnings, and a resilient macro environment marked by easing inflation...

Trade policy disruptions and Fed policy responses created a backdrop of sharp volatility followed by a swift and powerful market rebound in Q2. Surging interest in tech and AI along...

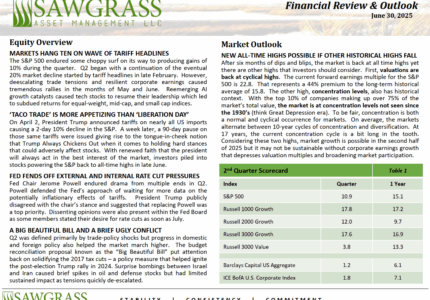

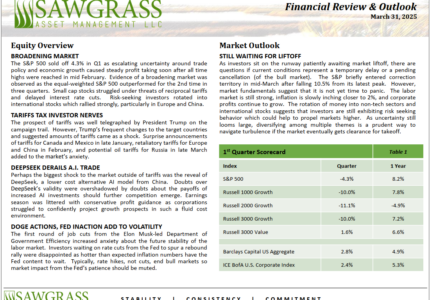

Market Review • The Russell 2000 Growth (R2G) lost -11.1% for the quarter. Uncertainty surrounding tariffs, persistent inflation, recession worries that accompany those items, as well as declining consumer confidence...

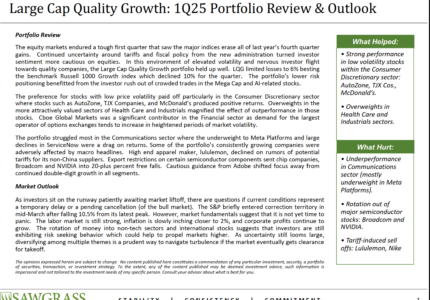

Portfolio Review The equity markets endured a tough first quarter that saw the major indices erase all of last year’s fourth quarter gains. Continued uncertainty around tariffs and fiscal policy...

Escalating uncertainty around trade policy and economic growth, amongst other factors, led to a risk-off environment throughout the 1st quarter. The S&P 500 sold off -4.3%, retreating substantially after reaching all-time...