Market Review

- Small stocks as measured by the Russell 2000 (R2) were up 8.5% in 2Q25 while the S&P 500 (SP5) rose 10.9% in the quarter. This extends large cap leadership to another extreme as measured by relative returns or valuations. Our benchmark the Russell 2000 Growth (R2G) generated a 12.0% return.

- The Mag 7’s market concentration will be helpful to our cause when it unwinds. At a recent price of $164, one of the Mag 7 darlings and one of the greatest stock market winners of all time, Nvidia, was worth over $4 trillion. That one stock is valued at over 130% of the entire R2. Every single company in the index.

- The total market cap of the R2 is only 5% of the SP5, more than two standard deviations below its long-term average and at an all-time low in the almost 50 years of its existence since 1979.

- The strong rally off the 4/8 lows featured very low-quality attributes. Among the strongest factors for the quarter were lowest absolute share price (<$5), heavy short interest, lowest market cap, and unprofitable stocks, none of which we look for. The worst performers of 1Q25 became the best.

- Smaller size proved better for performance during the quarter. Microcaps, after turning in a lousy 1Q25, reversed course and led the market in the high beta, low quality rally. Growth continues to dominate Value.

Portfolio Review:

- Small Cap Quality Growth (SCQG) underperformed for the second quarter (5.5% vs 12.0% for the R2G). This is not unexpected in a risk on, low quality environment like that of 2Q25. The R2G’s 12% return for the quarter equates to a 57% annual return, well beyond our definition of a speculative market and well beyond “escape velocity” in the recognition of a new bull market.

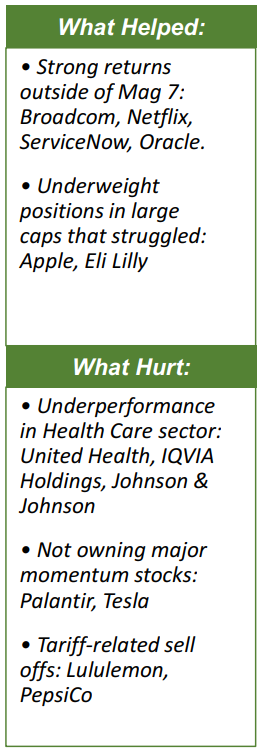

- Our model factors struggled in 2Q25. Price Volatility and Profitability, leading contributors in 1Q25, became the largest detractors from returns in 2Q25. Market Sensitivity (Axioma’s term for beta) was the strongest detractor from return, however, as high beta, low quality stocks set the pace for performance.

- Security selection was negative for the quarter with Industrials, Health Care and Technology giving up the most ground, 221bp, 150bp and 162bp, respectively. There were no exceptionally large negative contributors by position but rather, the factors that the portfolio is built on fell out of favor in the low-quality rally.

- Technology slotted four names into the top 10 contributors to return and six sectors were represented overall. StoneX Group (SNEX) topped the leaders, generating record operating revenues, net income, and earnings per share growth. It also strengthened its competitive position by acquiring R.J. O’Brien. Artivion (AORT) and Avepoint (AVPT) followed closely behind SNEX with the former receiving positive data for two product lines and the latter outperforming guidance and delivering strong growth in total ARR and record growth in net new ARR. On the negative side, Health Care placed five names on the largest detractors list.

Outlook:

- We have stressed three linchpins for the large to small leadership switch for multiple quarters: the relative valuation discount of small cap to large cap – continual trough valuations; the concentration of mega-caps as a percent of the total equity market – always a herald of large to small leadership switches; and finally, the duration of the large cap leadership cycle is the second longest in U.S. stock market history.

- Large caps’ relative return versus small caps over the last 10 years is +6.4% annualized. April 1999 marked the all-time high at +7.8%. Any time this number has been positive proved to be an excellent entry point for investing in smaller stocks and portended large relative gains in the subsequent 3, 5, and 10-year periods.

- Smaller stocks’ relative valuations to the overall market are also at an extreme. The normalized P/E relative to larger stocks is at a two-standard-deviation low, much cheaper than the COVID low, and was only cheaper during the internet bubble climax. Subsequent returns from these lows have been richly rewarding.

- Sawgrass’ risk-conscious Small Cap Quality Growth strategy generates portfolios exhibiting lower price volatility; stable, consistent growth; and attractive valuations. It is built for this market. The rubber band of the “linchpins” is stretched tight. When it snaps, small caps are likely to generate historical appreciation.