Portfolio Review

The growth index posted strong gains in the second quarter of 2025 supported by de-escalating trade tensions, better-than-expected earnings, and a resilient macro environment marked by easing inflation pressures. The most impactful catalyst may have been the return of the ‘FOMO’ (Fear Of Missing Out) trade which saw investors pile back into concentrated names and crowded themes. Given this speculative backdrop, the strategy struggled to keep up with the index as portfolio gains of 9.4% trailed the Russell 1000 Growth benchmark which advanced 17.7% during the same period.

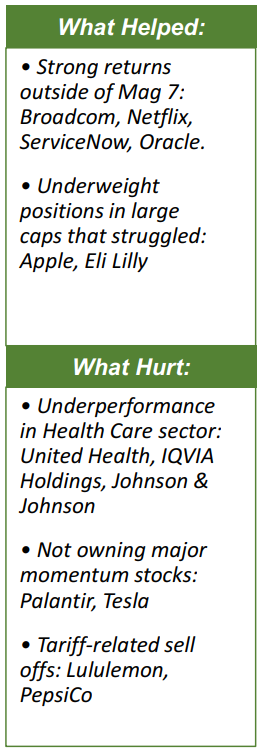

As market concentration intensified during the quarter, the portfolio found success in non-Magnificent 7 stocks. Companies such as Broadcom, Netflix, ServiceNow, and Oracle were top contributors that doubled the return of the index. The portfolio also owned many of the top performing Mag 7 stocks such as Microsoft, Meta, and Amazon though our underweight positions led to relative underperformance. Underweight positions in other stocks such as Apple and Eli Lilly were net positives for the portfolio.

The portfolio’s collection of high-quality health care stocks was challenged by adverse reactions to second quarter headlines. Investigations into potentially fraudulent practices at United Health and major clinical trial delays at leading contract researcher, IQVIA, exacerbated the decline of already reeling health care companies. As the FOMO trade accelerated in May and June, the omission of heavy momentum names such as Tesla and Palantir also hampered the portfolio’s relative return potential.

Market Outlook

After six months of dips and blips, the market is back at all-time highs yet there are other highs that investors should consider. First, valuations are back at cyclical highs. The current forward earnings multiple for the S&P 500 is 22.8. That represents a 44% premium to the long-term historical average of 15.8. The other high, concentration levels, also has historical context. With the top 10% of companies making up over 75% of the market’s total value, the market is at concentration levels not seen since the 1930’s (think Great Depression era). To be fair, concentration is both a normal and cyclical occurrence for markets. On average, the markets alternate between 10-year cycles of concentration and diversification. At 17 years, the current concentration cycle is a bit long in the tooth. Considering these two highs, market growth is possible in the second half of 2025 but it may not be sustainable without corporate earnings growth that depresses valuation multiples and broadening market participation.