Equity Overview

Roller coaster market moves bring new highs after big drops,

Q3 was a thrill seeker’s market as changing sentiment towards rates, the economy, and A.I. caused a roller coaster ride to new highs. US investors with strong stomachs were rewarded in the end as the S&P 500 gained nearly 6%. The long-awaited market broadening began early in the quarter with investors rotating away from mega cap tech into cyclicals and small caps. The rotation coupled with some soft economic reports pushed the market to a nearly 10% correction. Optimism over better prospects of a soft landing for the economy inspired the market to resume its climb and finish at all-time highs for the third consecutive quarter.

Fed speak and actions were well received by the market.

Investors appreciated the certainty amid a slew of conflicting economic reports. Inflation readings confirmed a sustainable cooling of price growth to the Fed’s target 2% level. Soft payrolls reports began casting doubt on the Fed’s ability to avoid recession while starting its easing cycle. Confident comments from Chair Jay Powell that the Fed was on top of the labor situation restored upside momentum to the market. Powell and company backed up their economic bravado with a half-percentage point cut in interest rates, the first such move since the Covid-19 pandemic of 2020.

Concerns over the resilience of AI revenues and consumer spending were major themes for the quarter.

Despite reporting continued growth in revenues, many AI-related stocks failed to meet high expectations when issuing guidance. Investors began selling off AI stocks early in the earnings season, but the AI trade was resurrected after optimistic reports were issued later in the quarter. Similar drama occurred with consumer stocks as many retailers warned about diminished spending observed in lowerincome consumers. Late quarter economic reports suggested that consumer confidence has faltered but spending remains steady.

Market Outlook

New trends needed for old trend of new highs

Many of the themes that have fueled this nearly 2- year bull market are showing signs of fatigue. The AI secular growth story is coming under more scrutiny, the idea of a resilient economy is being tested by shifting consumer patterns and the prospect of future volatility is making bonds a more attractive option than stocks for many nowwealthier investors. Speaking of volatility, it’s the one theme picking up steam as the uncertainty surrounding the upcoming presidential election and multiple ongoing foreign conflicts continues to spur investor anxiety. Recently observed volatility is mostly due to rotations into previously unloved pockets of the market. With rising levels of volatility likely ahead, a further broadening of the market may be the type of trend needed for future gains.

Fixed Income Overview

Fed Takes Action

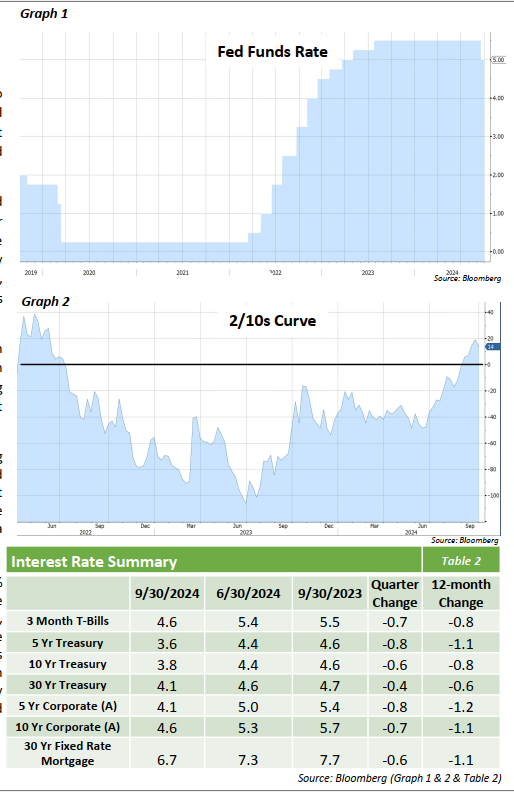

After much back and forth on the direction of interest rates, the market appeared to find its path in the 3rd quarter. For the first time since March 2020, the Federal Reserve cut the Fed Funds rate (Graph 1), which led to a sharp decline in interest rates across the Treasury Curve. Led primarily by this downturn in rates, the bond market performed strongly with the Bloomberg Aggregate posting a return 5.2%.

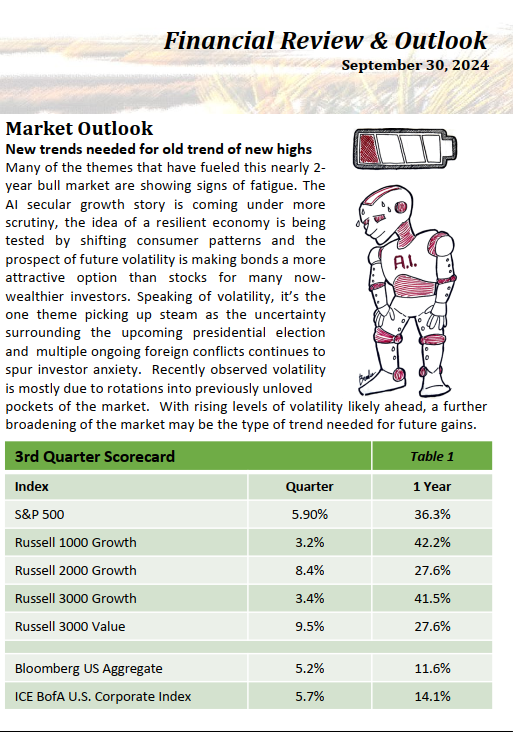

The question leading up to the September meeting was not whether the Fed would cut rates, but rather whether they would cut by 25bps or 50bps. With concerns over the labor market, the Fed took the proactive approach and decided on a more accommodative cut of 50bps. This action led to a bull steepening in the Treasury Curve with the front-end rates declining more than the long-term rates. The 2-year, 10-year, and 30-year Treasury rates were down 111bps, 62bps and 44bps respectively.

The behavior of the Treasury Curve led to an end of the 2/10s inversion that had been in existence since July 2022 (Graph 2), a record amount of time. Historically, an inversion in the curve has been a strong indicator of a recession but, with easing inflation and a labor market that has shown signs of resilience, the hope of a soft landing in the economy remains.

Although there have been periods of volatility in the asset class due to remaining economic uncertainties, corporate bonds have continued to perform well overall and spreads grinded tighter by 4bps during the quarter. With spreads sitting at historically tight levels, the margin for error within certain aspects of the corporate bond market is very slim and a downturn in economic activity could lead to a widening out of spreads.

While interest rates have come down, the yield on the Bloomberg Aggregate of 4.2% at quarter-end is still high on a relative basis and is at levels not seen since 2009. The magnitude of Fed Fund rate cuts is unclear and will be dependent on many factors, including the strength of the labor market and inflation. What is clearer is that the direction of the Fed Funds rate should be downward and, in fact, the market is currently pricing in another 75bps of rate cuts in 2024. This action could present an opportune time for fixed income investors. The end of the year could have many surprises, including a Presidential election, that could cause bouts of volatility and further magnify the importance of high-quality securities within a bond portfolio.

Opinions expressed herein are subject to change.