Equity Overview

Markets stay high with A.I.; corporate optimism and consumer data goes low.

Frenzy and familiarity fueled a nearly 16% gain in the S&P 500 through the first half of 2024. Investors continue to lust for all things AI-related, mostly using NVIDIA stock to satisfy their desires (the stock is up 149% YTD). The intensifying concentration of investor flows into large cap tech stocks has overshadowed emerging concerns about future earnings growth and a weakening consumer. This blissful ignorance is reflected in the glaring disparity between gains in growth stocks (+20% YTD) versus their value counterparts (+6%). Other asset classes are also struggling. Both mid-size and small company stocks fell 3% each in Q2. Small caps are still slightly negative for the year.

Big Tech dominates returns and earnings growth in first half 2024.

The market seems fine with tech stocks driving returns, but a market breadth problem is emerging. The tech-heavy Nasdaq 100 index was up 8% for the quarter but the equal-weighted version of this index was slightly negative (-0.3%). The broader equal-weighted S&P 500 index also fared poorly (down 3%) against its market-weighted twin which gained 4%. The breadth problem extends beyond pure price returns. Reported Q1 earnings growth for the market of 6% was ahead of consensus estimates. However, this growth was skewed by the Magnificent 7 (NVIDIA, Alphabet, Amazon, Apple, Meta, Microsoft, and Tesla). Outside of those stocks, average earnings growth fell by 2%.

Concerns over weakening consumer, slowing economy bolster case for rate cut.

A major contributor to weak performance outside of the tech sector was the chorus of concerns echoed by management during earnings season. Many large retailers announced price-cutting initiatives as they began worrying about consumer resilience after multiple years of high inflation. Economic readings seemed to support the notion of slowing growth as retail sales, industrial orders, and housing data reports set multimonth lows. The silver lining of a cooling economy was the extinguishing of speculation about rate hikes. Although the Fed started the year predicting three rate cuts, it seems almost certain that the market will see at least one before 2024 is over.

Outlook: Something’s gotta give.

With secular AI themes, the specter of rate cuts, and rising corporate profits, there are plenty of tailwinds for continued market growth in the second half. Most of these tailwinds seemed to be pulled forward into firsthalf performance (which was then concentrated into the Mag 7 stocks). To date, only 25% of the S&P 500 stocks have actually outperformed the market. It seems intuitive that broader participation would make future market gains more sustainable. Even if narrow leadership continues into 2H24, stubborn inflation, economic weakness, and election angsts could introduce volatility among the mega cap stocks and longawaited opportunity for the rest of the market.

Fixed Income Overview

A Market Trying to Gain its Footing

Halfway through the year, the bond market is still trying to gain clarity on the overall direction of interest rates and the Fed. While the 2nd quarter return of +0.07% in the Bloomberg Aggregate was relatively subdued, the intra-quarter volatility tells a different story. The monthly returns of -2.53%, +1.70%, and 0.95% respectively for each month were indicative of the choppiness seen in the market.

Much of the volatility has been an indication of the market trying to gauge what the Fed’s next step will be. Moderate signs of easing inflation provide hope for an early cut in rates. While the consensus is that the path of the Fed Funds Rate will be downward, the amount of 2024 rate cuts expected by the market has vacillated between one and two.

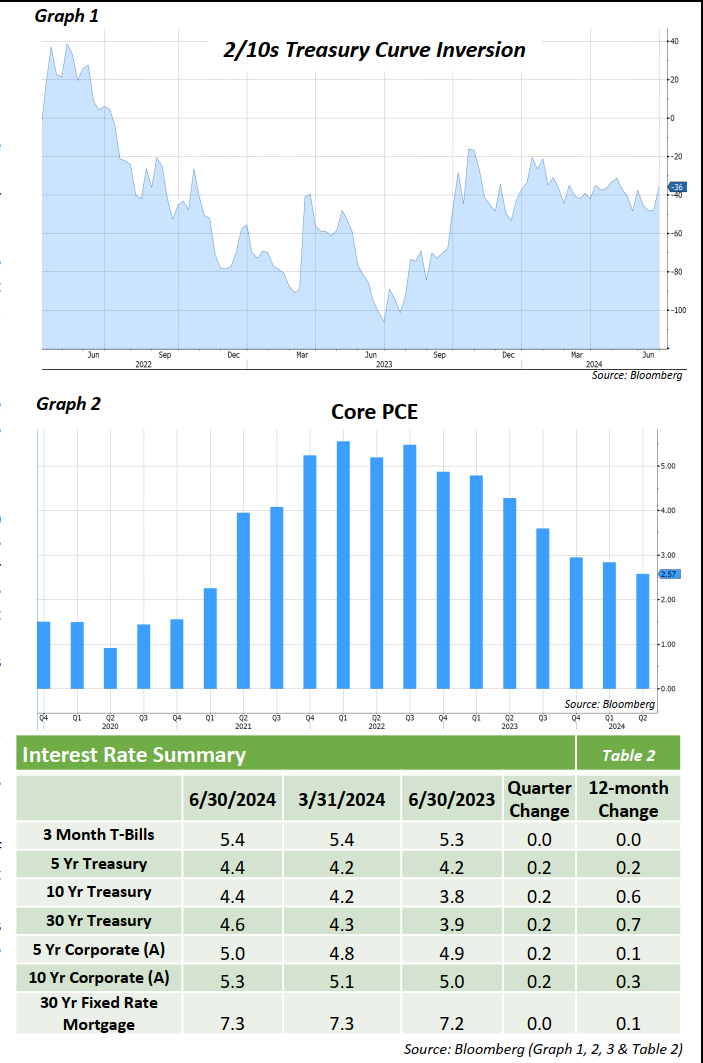

Treasury rates were up slightly across the curve, with the 2-year Treasury up 9bps, the 10-Year up 8bps and 30-year also up 8bps. However, most of this movement can be traced back to April and, since that point, Treasury rates have consistently trended downwards.

The 2/10s Treasury Curve Inversion continues (chart 1) and has now exceeded 700 days since July 2022, exceeding the previous record of inversion in August 1978. While an inverted yield curve has typically been an accurate predictor of a slowdown or recession, the present economy has remained resilient in many respects. There are factors that have worked in the economy’s favor (fewer borrowing needs in tight conditions, excess savings built up, Fed intervention, etc.) but the inversion is still having an effect in many ways and, until the curve normalizes and steepens, may act as a deterrent to economic growth going forward.

Corporate bonds, which have been trading at historic tight levels in recent quarters, started to show some weakness towards the end of the quarter. The fundamentals on corporate bonds remain strong but with persistent inflows and tightening spreads, the asset class has become a bit overvalued which has led to a subsequent sell-off.

Economic growth, while strong, is showing signs of moderating. The same signs of abating can be seen in inflation as measures, including the Fed’s preferred data point of Core PCE (chart 2). While the amount of expected Fed cuts has decreased throughout the year, the market has stabilized around the overall trajectory. Yields remain high and, with the most likely path of interest rates being downward, we believe this is an ideal time to increase exposure to high-quality fixed income.

Opinions expressed herein are subject to change.