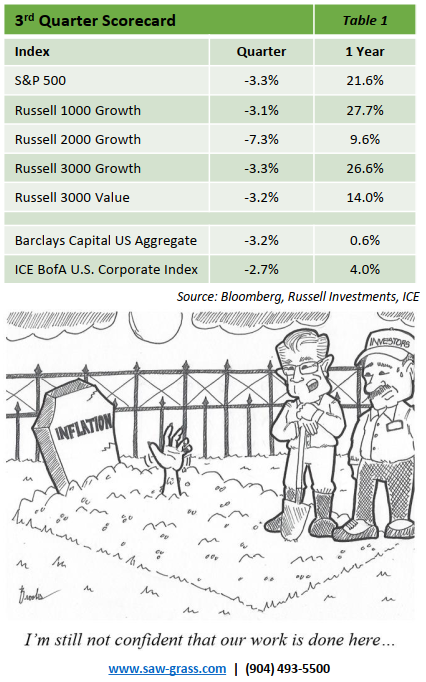

Summer stock market rally fizzles as bond yields sizzle.

Despite a strong start to the summer, the S&P 500 fell over 3% as growing themes surrounding inflation tailwinds and economic growth headwinds began to worry investors. The market moved consistently higher in July, finishing with the year’s highest close on the last day of the month. Treasury rates began rising in August and jumped to their highest level (on the 10 year) since 2007 during September. Stocks fell accordingly, producing the first back-to-back monthly declines for the year. Small-cap stocks, weighed down by fears of elevated inflation and interest rates, underperformed their large-cap peers with a 5% loss for the quarter.

Market returns stay narrow as challenges to future earnings grow broader.

The seven largest stocks in the S&P 500 (which have driven most of the year-to-date returns) had mixed performance in Q3, though they still outperformed the other 493 stocks in aggregate. That should raise eyebrows as most of the investor community assumed that a pullback in the mega cap stocks would correlate with outperformance from the broader market. Instead, the equal weighted S&P index lagged the overall S&P 500 by over 2% for the quarter. With re-emerging China growth concerns, spiking energy prices, and dwindling post-pandemic savings, the only thing that seemed to broaden out in Q3 were obstacles to future earnings growth..

Investors still hoping for a soft landing, but Fed causes turbulence mid-flight.

Actions by the Federal Open Market Committee to hike rates 0.25% in July and hold them steady in September were widely expected by the investor community. The unwelcome surprise of the quarter occurred in the September meeting when the Fed forecasted a lower magnitude of rate cuts for 2024. Investors longing for a defined peak in the rate hiking cycle were disappointed as the Fed reiterated its higher-for-longer warnings. Stronger-than-expected economic reports seemed to justify the Fed’s cautious stance as payrolls and jobless claims data continue to show a resilient labor market. Rising oil prices also contributed to slightly higher inflation readings.

Outlook: Tis the season to be jolly…or spooked.

Few things signal the arrival of fall better than a curious desire for pumpkin spice lattes and a September decline in the markets. Since 1928, September has consistently been the worst performing month for the S&P index. On the bright side, Q4 has been the best performing quarter over the same time period. Plenty of bullish themes are available to excite investors going into year-end such as upbeat earnings revisions and positive macro reports supporting the soft-landing narrative. However, looming issues such as the resumption of student loan payments, labor union strikes, growing deficits, and a potential government shutdown could lead investors looking for market treats to be tricked by the ghosts of headline volatility.

Bond Volatility Makes a Return

Halfway through the year, the bond market showed signs of stabilization as the Bloomberg Aggregate posted a return of 2.1% through June 30th. Unfortunately, a hawkish tone led to a rise in interest rates, and the Bloomberg Aggregate gave up all those gains and more. The 3rd quarter return of -4.3% harkened back to the dismal 2022 returns and drove the 2023 YTD performance down to -1.4%.

Twelve years after S&P first took the step of downgrading the U.S. credit rating, Fitch followed suit and did the same in August. The ratings agency cited the growing debt burden, fiscal deterioration, and repeated debt-limit standoffs. The political deadlock has shown no sign of abating as the government narrowly avoided another shutdown on October 1st. With only a temporary reprieve on funding until November 17th, the prospects of repeating such last-minute deal-making is set to bring further anxiety to

financial markets and the economy.

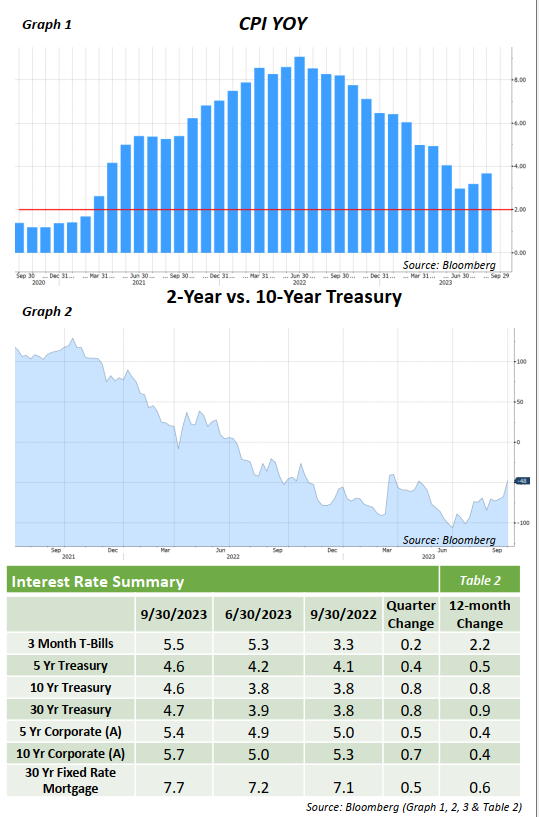

After hiking another 25bps in July, the Federal Reserve paused at their September meeting. Still, the rhetoric from the meeting signaled a tone of “higher for longer” interest rates, explicitly projecting fewer rate cuts in 2024 than previously indicated. The higher rates are being fueled by continued inflation fears and a job market that, while beginning to moderate, is showing resilience. Inflation is undoubtedly down from its peak of 9%, but at 3.7% YOY (chart 1), it remains above the 2% target rate that

has been set by the Fed.

In a reversal of a recent flattening trend, the U.S. Treasury curve exhibited a bear steepening for the quarter, with the 2-year moving up 15bps and the 10-year up 73bps. This movement in the curve brought the level of inversion between the 2-year and 10-year down from 106bps to 48bps (chart 2).

Despite the turmoil in the equity markets (S&P down -3.3%), corporate bond spreads have continued to hold in and tightened by 5bps for the quarter. The appeal of higher yields and a lack of supply early in the quarter led to higher demand for the asset class.

Financial markets continue to be roiled by a litany of factors, and the bond market has not been immune to this volatility. While it does appear that the Fed is nearing the end of its hiking cycle, it is also clear that the prospect of persistent higher rates is becoming more of a reality. With each new economic and political concern, the probability of a soft landing is lowered. Given the degree of uncertainty, we believe that a bond portfolio emphasizing high-quality securities is the most prudent and has the best chance of outperforming in the future.

Opinions expressed herein are subject to change.