June 30, 2019

Volume 22; Issue 2

Equity Market: Quarter in Review

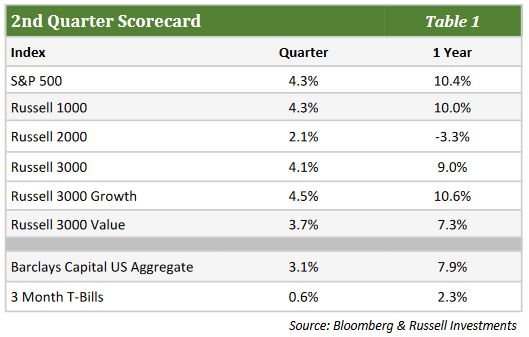

- The S&P 500 produced an impressive 4.3% gain despite a volatile quarter as changing sentiment from the Fed and wavering confidence on the ability of the US and China to resolve their trade disputes swayed the market.

- As has been the case for most of this 10-year bull market, large cap stocks outpaced small caps though the rally felt defensive as Low Volatility and Low Beta stocks registered the highest returns among factor groupings.

- Market movements seemed highly correlated with the trajectory of US-China trade talks as a mid-quarter breakdown in negotiations caused a severe market slump in May, and renewed optimism of a trade resolution spurred a strong rebound to finish the quarter.

- Investors also cheered the Fed’s pivot from a neutral stance to a dovish outlook which may seem odd given the economy remained solid enough to propel the market to its best first half since 1997.

- Much like last quarter, the market’s rally was broad reaching as all sectors finished in positive territory with the exception of energy stocks which suffered from the decline in crude oil prices.

Equity Market: The Quarter Ahead

- As the S&P 500 made a new high at quarter end, investors have enjoyed one of the longest and strongest bull markets in history and the lingering question continues to be, “How much further do we have to go?”

- Some suggest that stocks will be propelled higher by lower interest rates, a product of a weaker economy, while others might suggest that trade resolutions with China will foster a stronger economy pushing stocks higher. It seems unlikely that both scenarios can be accurate.

- What does seem likely is that the pace of returns is unlikely to continue. The 15% average return of the last 10 years is well above long term averages.

- While trade and the Fed continue to dominate headlines, the market still has many other headwinds to prolonged growth – flaring geopolitical tensions, global economic slowdowns, predicted negative earnings growth domestically, and signals from the bond market that a recession is imminent.

- The amount of uncertainty surrounding these issues suggests that the road higher for the market is likely to be bumpy putting this fatigued bull run in danger of a potential stumble that could lead to a devastating fall.

Fixed Income Markets

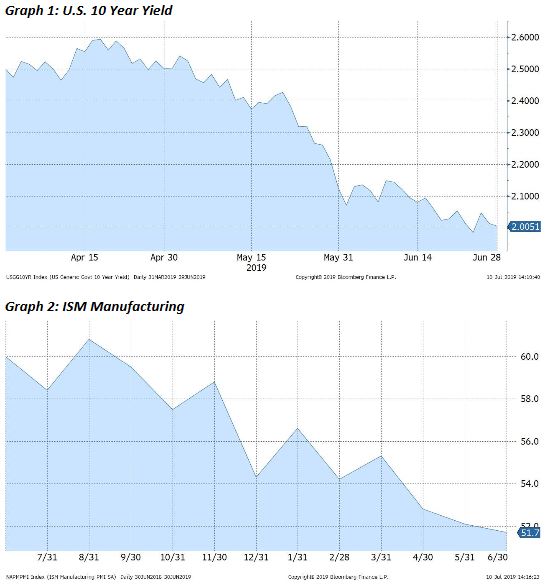

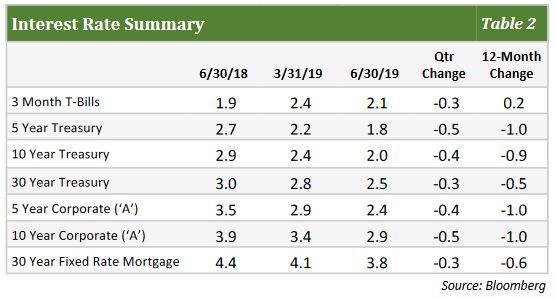

Second quarter 2019 returns once again represented a dispersion among asset classes. The stock market continued its rally as the S&P 500 was up +4.3% for the quarter, which would indicate a certain level of confidence in growth prospects. The bond market, on the other hand, seemed to reflect a much higher level of concern of slowing growth and the possibility of a recession. The sharp movement down in rates that was seen indicates a flight to quality. Interest rates were down across the curve with the 10-year Treasury being down 40bps, ending the quarter at 2% (See Graph 1). Mainly because of the movement down in rates, and subsequent increase in prices, the Barclays Aggregate was up 3.1% for the quarter.

It could be said that the current economy can be viewed as a bit of Rorschach test with market participants seeing what they want to see. The bulls can see what they want to back-up their beliefs that growth is strong, and bears can find data points that point to a slowdown and oncoming recession. The current economic cycle, starting in June 2009, recently broke the previous record of 120 months of economic growth from March 1991 to March 2001. The pace of the recovery, however, has been deliberate and slow. Wages and inflation picked up as the recovery continued but have shown recent signs of stagnation. Recent slowdowns in employment, housing and manufacturing (See Graph 2) have only exasperated some of the concerns of domestic growth.

These recent slowdowns have had an impact, not just on rates, but on the rhetoric that has come out of the Federal Reserve as it relates to future rate decisions. Going back to the beginning of the year, the market was pricing in a strong possibility of zero rate changes. The dovish sentiment coming out of the Fed, due to previously mentioned concerns as well as trade wars and global growth worries, have shifted market sentiment. The market is now pricing in both a rate cut in July and another in December. This pivot from the Fed has had a clear impact on the movement of rates. The shift down on front end of the yield curve is impacted directly by Fed decisions while points further out on the curve are a reflection of long term growth prospects, therefore signaling a level of concern.

At Sawgrass, we believe the extended recovery has caused certain asset classes within fixed income, such as corporate bonds, to become overvalued to an extent. There are many indicators signaling a slowdown and we believe that reducing overall risk is an appropriate response. With potential for increased volatility, investment opportunities should continue to become available and we plan to take advantage when they do.

The opinions expressed herein are subject to change. Please contact us for further details at 904-493-5500.