September 30, 2018

Volume 21; Issue 3

Equity Market: Quarter In Review

- The equity markets continued their trek higher during the quarter as the major indices added another 7-9% gain to bring year-to-date returns well above 10%.

- Stocks did not experience any meaningful sustained volatility, as sell-offs were short, followed quickly by new highs. Most of the large cap indices ended near their quarterly highs.

- Factor strength was focused on profitability, stability, and lower volatility.

- Small and value under performed large and growth once again as the best sector performers were healthcare, industrials, and information technology, while the relative laggards in this strong market were energy, materials, and financials.

Equity Market: The Quarter Ahead

- The sell-off that has occurred in early October has likely been long overdue as the sharp rise in rates makes current valuations even less attractive giving the markets ample reason for profit taking to start in a more meaningful way.

- Earnings and economic growth have improved substantially from earlier levels, making a stronger case for the market’s elevated valuation multiples and better current fundamentals to support the bull case. However, the one-time boost from the tax cuts will begin to roll off in coming months leaving comparisons less favorable.

- Continued tightening of monetary policy by the Federal Reserve is removing some of the extraordinary monetary accommodation from the last decade. This normalization will provide the Fed with some ability to move in the future but is likely to be met with greater volatility in the markets as this support is removed.

- The upcoming mid-term elections remain a wild card that could leave markets in flux until they pass and the potential year-end rally is allowed to take hold.

- The markets are likely to continue to experience volatility as the quarter progresses until a more meaningful bottom is reached, allowing stocks to regain their footing heading into year end. A big question remains whether this is just a quick profit taking correction that will serve as the base for a more sustainable break to new highs or a more meaningful sell-off that will correct some of the market’s larger gains from this 9+ year bull market.

Fixed Income Markets

- In December 2015, after nearly seven years of zero percent interest rates, the Federal Reserve raised their interest rate target rate by 25bps. Since that time, they have raised rates by an additional 25bps a total of eight times.

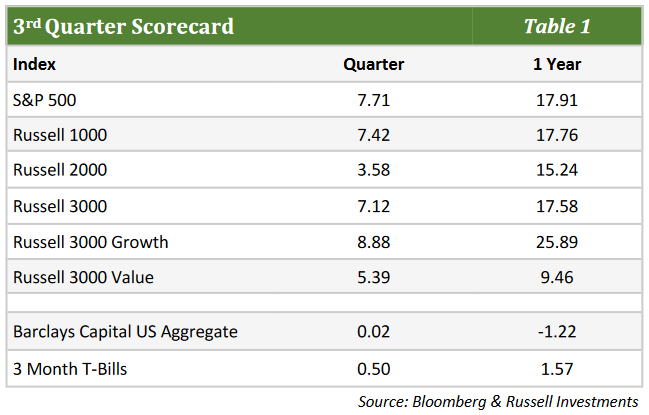

- After seven years of accommodating zero-percent rates led to an equity bull market and tightening corporate bond spreads, the gradual rate hikes were intended to normalize growth and prevent an overheating economy. However, since the date that the Fed lifted rates in 2015, the S&P 500 is up 50% and corporate bond spreads have tightened by an additional 60bps. With the tightening of monetary policy, fiscal policy action may have been necessary for the economy to expand further. That was accomplished, mainly with the cutting of the corporate effective tax rate. While it is still yet to be determined if the tax cut will be a short term “sugar high” or set the tone for sustainable growth, it is clear that the Fed rate hikes have not yet affected the upward trajectory of asset prices since they began. Consensus has been that the rate hikes will continue into 2019, ending sometime in 2020 at which point the economy could grow at a normalized pace. But, if employment continues to grow (Graph 1) along with low volatility and rising asset prices, the path of rate hikes may continue longer than expected.

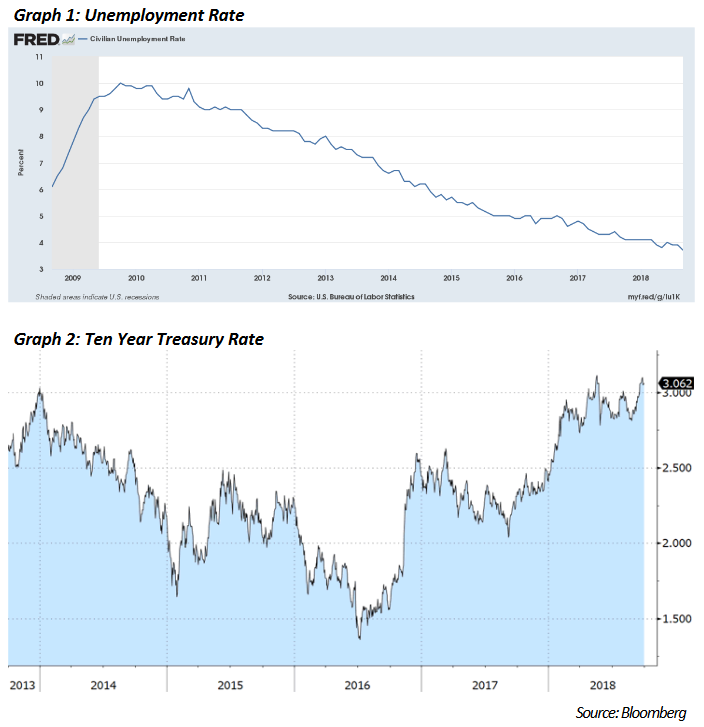

- The third quarter exemplified the recent trends that have existed in the marketplace. The Fed raised interest rates once again, and Treasury rates were up across the curve as the economic outlook remained strong. The 10-year Treasury was up 20bps, closing the quarter at 3.06%, approaching the highs of the last 5 years (Graph 2). Even with continued rising interest rates, the S&P 500 returned 7.7% and corporate bonds tightened by 17bps. The economic outlook does include areas of concern as well that could derail its course.

- During the second quarter, trade deals were struck with both Mexico and Canada. While each of the deals offered only incremental change from previous deals, the overhanging risk of further tariff escalations was removed, pending congressional approval on both deals. However, trade talks with China have not progressed and further rounds of tariffs were enacted. Continued escalation could start to have a larger impact on various industries and further trickle down to consumer prices, impacting growth. As the U.S. heads into mid-term elections, uncertainties abound but a majority of the data reflects an economy that does not plan to slowdown in the near future.

The opinions expressed herein are subject to change. Please contact us for further details at 904-493-5500.