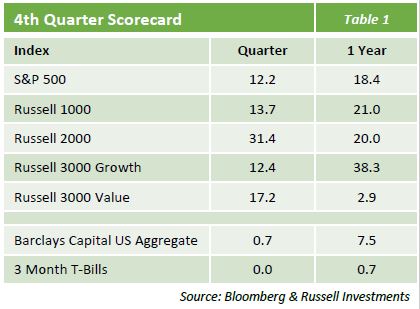

Equity Market: Quarter in Review

- A global health pandemic and volatile US election campaign were no match for the market’s resilience as the S&P strongly rebounded from early losses to finish the year up 18%.

- After a nearly 5% move to start the year, the worldwide economic shutdown torpedoed the market by more than 30% over a 6-week period before monetary stimulus, hopes of eventual economic recovery, and vaccine developments propelled the market nearly 70% to end 2020 at record highs.

- The aggressive monetary and fiscal measures which included extended unemployment benefits, direct payments, and the Paycheck Protection Program eventually turned the tide of declining investor confidence into profitable exuberance.

- Surprisingly, the US election failed to meaningfully change market direction as investors felt the impact of the pandemic provided certainty that both candidates would be loathe to promote legislation that could hinder economic growth.

- Although large cap growth stocks continued their dominance, 2020 provided opportunities to invest in multiple styles with periodic success.

- Momentum stocks surprisingly led both the initial rally and subsequent Q1 pullback, high beta stocks ruled the Q2 rebound, low volatility stocks had a good showing in Q3, and Value stocks finally led the way in the last quarter of the year.

- Information Technology stocks consistently paced the market as the increased need to stay connected made the durability of their services more attractive while Consumer Discretionary rallied the strongest from the March lows and finished with the second-best sector performance.

Equity Market: The Quarter Ahead

- With the uncertainty of a major election and the certainty of committed Fed support behind it, the market seems positioned to continue its trek higher as 2021 starts.

- The tangible delivery of multiple vaccines could be another shot of confidence for the markets leading investors to believe that economic recovery is more of an eventual reality than a questionable outcome.

- The current reality is that investors have poured large sums of money into the markets for 9 months pricing in robust expectations of recovery that may prove harder to reach if COVID cases fail to meaningfully decline.

- With that backdrop, it is reasonable to expect that any market climb higher may have increasing levels of volatility as excess investor enthusiasm wanes and buy-sell decisions become more focused on actual data points instead of riding the momentum wave.

Fixed Income Market

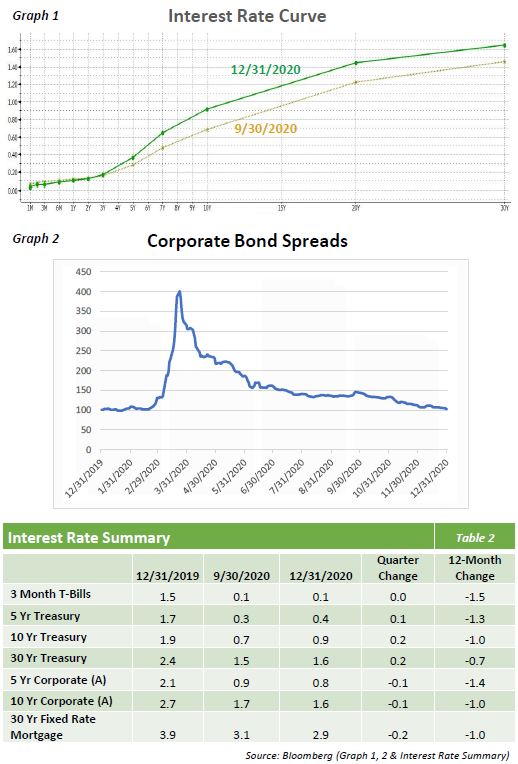

- The fixed income market vacillated between the fears of further lockdowns and the hope of a vaccine, and what that could mean for a potential rebound in the economy. The wrath of the virus, and its impact on the economy in the near-term, has been relentless. However, it is also clear that investors are focusing more on the “hope” trade and looking forward to a rebound in 2021 and beyond.

- Economic fears also continued to be muted by the actions of the Federal Reserve and their continuance of easy monetary conditions. The commitment to low interest rates and bond purchases has provided a floor for risk assets, enough to overcome anxieties elsewhere.

- The movements in the interest rate curve indicated expected growth in the economy as there was a steepening seen in Q4, with the 10-year and 30-year increasing 23bp and 19bps respectively (Graph 1). Countering the upward trajectory of the longer segment of the curve was the lack of movement in the front-end, which was generally flat for the quarter.

- Despite poor economic conditions, corporate bonds exhibited the risk-on mentality that was seen across most asset classes in the 4th quarter. The investment grade corporate bond index tightened by 41bps, bringing the level back to its pre-pandemic range (Graph 2).

The opinions expressed herein are subject to change. No content published here constitutes a recommendation of any particular investment, security, a portfolio of securities, transaction, or investment strategy. To the extent any of the content published may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Consult your advisor about what is best for you.