December 31, 2019

Volume 22; Issue 4

Equity Market: Quarter in Review

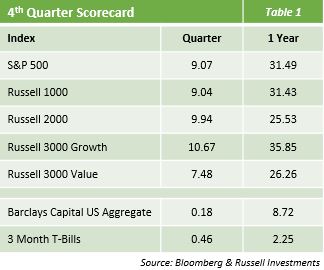

- Investors who were savvy enough to ignore the overwhelming amount of 2019 predictions for a muted, or even negative market return, were rewarded handsomely as the S&P 500 soared over 31%; its best return since 2013.

- It was difficult NOT to make money in 2019, as every major mix of investment styles (large, mid, small, growth, blend, value) and factor tilt (high beta, low volatility, quality, momentum, etc.) earned at least 20% in one of the most broad-based market advances in history.

- All of the uncertainty that led to predictions for subdued returns turned out to spur the market forward as investors reacted positively to potential resolutions in various areas ranging from Fed positioning to Brexit agreement to the exhaustingly bi-polar US-China trade negotiations.

- The final quarter of 2019 was characterized by a steady march higher as the market rose for 11 out of 13 weeks, totaling an impressive 9% return (the second largest since 2013) and reaching a new historical high for the third consecutive quarter.

- Continuing the theme of a broad-based rally, all sectors finished the quarter in positive territory with the standout being Technology stocks, which not only led for the quarter (+14%) but also made the S&P’s 31% annual return look mundane as the sector climbed 50% for the year.

Equity Market: The Quarter Ahead

- The unusual strength of the markets in the fourth quarter suggests that stock gains are being propelled more by the fear of missing out, aka FOMO, phenomenon than an environment ripe with good economic fundamentals and corporate earnings growth.

- To be sure, EPS growth in 2019 did exceed consensus expectations but the bar had been set extremely low and is estimated to stay low as forcasted growth next year for the S&P 500 is set at a paltry 0.3%.

- Economic indicators look less dire as personal consumption, retail sales, and payrolls continue to tick up but manufacturing indexes fell to contractionary levels and the bond markets signaled that recession worries are on investors’ minds as yield curves briefly inverted.

- Political uncertainty is poised to bring more volatility into the mix for the start of 2020 as tensions in areas such as the Middle East and China continue to simmer and the US ramps up for an election that is likely to feature candidates on diametrically opposed ends of the political spectrum.

- The future for the coming year is just as murky as the beginning of 2019 with the notable exception that stock prices didn’t receive a massive fourth quarter discount – the opportunity to buy low is much more scarce which could eventually dampen investor demand for stocks should volatility rise.

Fixed Income Market

- Relative to the volatility seen in recent periods, the performance in the bond market was somewhat subdued in the 4th quarter. This muted market movement was not necessarily a reflection of the potential catalysts that exist, both to push markets up or down. In what could be a testament of the numbed reaction to the current continuous state of the news cycle, this quietness took place in a quarter in which two trade deals were potentially agreed upon (USMCSA and Phase One China Deal) and the President of the United States was impeached by the House of Representatives. Still, the markets seem to be taking a wait-and-see approach on economic news to determine which direction they want to move.

- This patient approach could also apply to the actions of the Federal Reserve. In the Fed’s December meeting, it was decided to keep the Federal Funds rate unchanged following up on three prior cuts. The determination being that the “current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation near the committee’s 2 percent objective.” This stance may also project into next year as the consensus from the governors is presently no further rate hikes in 2020.

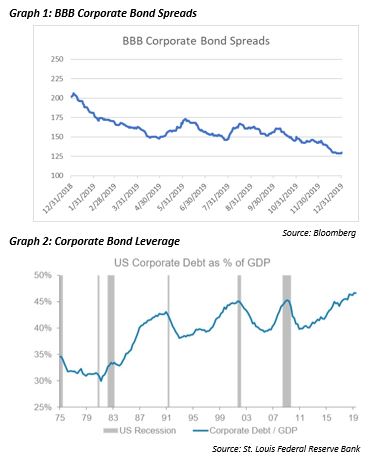

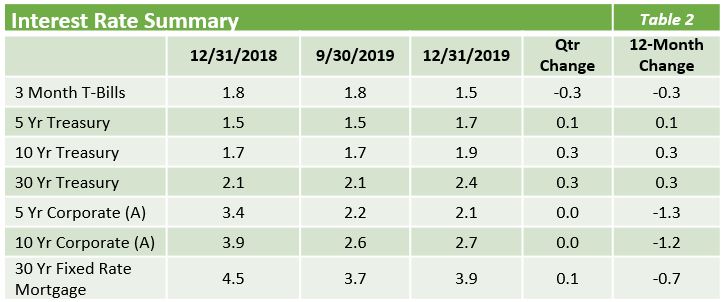

- While previous bouts of global economic weakness and an inverted yield curve recently brought about fears of a near-term recession, those worries do seem to have abated. The 2s/10s Treasury spread, which had briefly inverted in the 3rd quarter, widened out by 35bps by the end of the 4th quarter. The optimistic viewpoint of investors led to corporate bond spreads continuing to grind tighter with money flowing into the asset class. Despite being near all-time lows, BBB corporate bond spreads tightened by another 17bps on the quarter and 72bps on the year (Graph 1). Those low spreads, coupled with corporate bond leverage at historic highs (Graph 2), provide a level of concern for the future performance of corporate bonds should there be any signs of weakness in risk assets.

- The steepening and rising of interest rates during the quarter (10-year Treasury up 14bps) countered the outperformance of corporate bonds, leading to minimal return of 0.2% in the Barclays Aggregate. Given the aforementioned concerns regarding the relative valuation of corporate bonds, we remain underweight the asset class and await further weakness to present a more attractive entry point. With interest rates fluctuating, we will remain active in adjusting our overall duration position to take advantage of the movements. As we know, calm can many times precede a storm. While we foresee an extended period of low growth in the near-term, we believe it is best to retain a liquid portfolio of high quality bonds that will allow us to shift positions and take advantage of any market scenario as we enter 2020.

The opinions expressed herein are subject to change. Please contact us for further details at 904-493-5500.