December 31, 2018

Volume 21; Issue 4

Equity Market: Quarter in Review

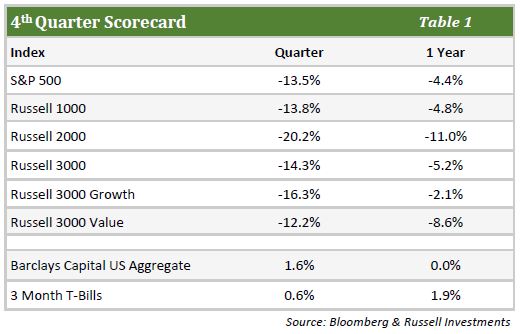

- The tone of the equity market shifted dramatically as the S&P 500 fell more than 13%, its worst quarterly performance in more than seven years and one of the largest 4th quarter declines ever.

- This was also the first negative year (-4.4%) since 2008, ending a nine-year run of positive returns, one of the longest such streaks in 100 years.

- Following many years of low volatility, the markets experienced over 20 trading days of greater than 1% price changes during the quarter.

- After making new highs in September, the building tensions of political instability, slowing global growth, and the uncertainty of Federal Reserve monetary policy finally took its toll on the equity markets.

- Factor strength was indicative of a significant move to “risk off” as lower volatility, lower beta, higher stability, and profitability were rewarded during the tough quarter.

- Large and value significantly outperformed small and growth, as the top sector performers were utilities, consumer staples, and healthcare, while the downside leaders were energy, information technology, and industrials.

Equity Market: The Quarter Ahead

- The markets have reached an important juncture where the momentum of a persistent bull market meets the reality of what happens when momentum shifts the other way.

- Valuations have improved given the selloff, but have only moved closer to “fair value” and are far from levels one would call cheap.

- The technical damage done during the selloff may take some time to heal and moves in both directions may be sharp as the market finds equilibrium.

- Political uncertainty, slowing earnings growth, and shifting fiscal policy remain real risks that could be difficult for the markets to discount going forward and could potentially become more problematic as 2019 progresses.

- Unless valuations return to stretched levels, market returns should be more modest, with earnings growth expected in the 5%-8% range for 2019.

- Given the probability of a return to more volatility, we believe it’s prudent to remain “risk aware” in this evolving climate.

Fixed Income Markets

Fixed Income Markets

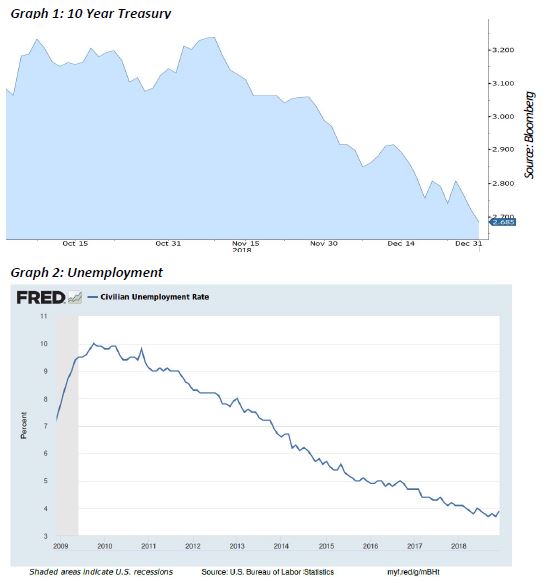

Just three months ago, the markets seemed to be hitting on all cylinders as the S&P 500 was up over 11% and increases in interest rates were reflecting expected strong growth. Any potential pitfalls (i.e. tariffs, rate hikes) seemed to fade into background noise as the drums of a bull market continued to bang and drown them out. As investors have learned many times in the past, markets can be very fickle. As the 4th quarter certainly proved, a risk-off sentiment quickly took over. Corporate bond spreads reflected the weakness, widening out by 46bps. The risk-off was seen in the Treasury market as safe haven assets were in demand, pushing the 10-year Treasury down by 38bps (Graph 1).

In trying to negotiate and redo legacy trade deals, tariffs were implemented, which have now started to show real effects on consumer prices and company profits. The disorder has not been isolated to the United States as global weakness is weighing on various markets. In Europe, Brexit negotiations and continuing budget concerns in Italy have tempered enthusiasm for markets as well.

Ongoing issues in Washington DC have only exacerbated some of the fundamental issues facing the markets and economy. On December 21st, with no resolution related to border security, the US Government shut down. With no clear end in sight to the shutdown, the markets took the uncertainty as a sign to continue to sell off. The Federal Reserve once again raised interest rates by 25bps in December, making it the 9th rate hike since 2015. Volatility, economic concerns and pressure from President Trump all made the December rate hike much more than the mere formality it was once considered. Recent dovish comments by the Fed Chair Powell (the walk back of Balance Sheet reduction is on “Auto Pilot,” and the Fed will be more data dependent) introduced the slight probability of a rate cut for 2019 now priced in the Fed Funds Futures market, which marks a major shift to market consensus from previous quarters.

All the turmoil has once again triggered talks about the timing of the next recession. Despite all the gloom seen in asset prices, the economy is still showing plenty of signs of strength. Unemployment ended 2018 at 3.7% (Graph 2) with inflation remaining low at 1.9%. While some signs point to a healthy economy on good footing, it is also clear that the markets are telling another story. If negative sentiment becomes too strong, those thoughts can filter into the economy and become reality. In such turbulent times as these, we believe a high-quality portfolio that is able to withstand potential shocks should outperform.

The opinions expressed herein are subject to change. Please contact us for further details at 904-493-5500.