Equity Market: Quarter in Review

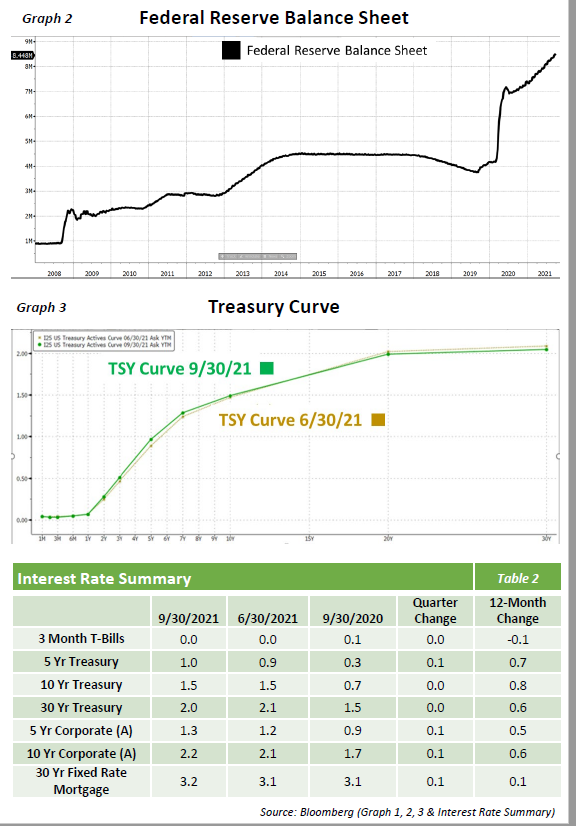

- The Dow, Nasdaq, and Russell 2000 ended down for the third quarter. However, the S&P 500 did post a gain for the sixth straight quarter.

- Q3 started off strong with easier financial conditions, accommodative monetary policy, pent-up demand, and big earnings beats all contributing to strong market returns.

- However, sentiment deteriorated in September as rising interest rates combined with inflation fears and the prospect of a less accommodative Federal Reserve led to a market pullback.

- Growth outperformed value for a second straight quarter but value continues to hold the advantage when looking over the last year given the strength in energy and financials. The value indices outperformance is not as indicative of broader strength in the valuation factor as the sector returns are a major contributing factor.

- Financials posted the strongest performance for the quarter with leadership from the banking group. Healthcare was also strong with strength from pharma and distributors. Industrials, materials, and energy were the worst performing sectors for the quarter.

Equity Market: The Quarter Ahead

- The equity markets have posted another impressive year to date gain on top of a historical run from the March 2020 lows. The pace of gains should be expected to significantly moderate going forward with heightened risk for larger corrective activity to balance some of the excesses in bullish investor sentiment. The trend toward more attractive valuation and more consistent growth characteristics has not reached the sustained period of outperformance yet but all signs point to a greater chance of this outcome.

- Interest rates began to climb again after a multi-month retracement of the sharp move higher earlier in the year. A sustained move upward in rates or even a higher plateau could have significant ramifications for a highly levered economy and an equity market with historically elevated valuations.

- The push/pull relationship between riskier, higher volatility factors and their lower risk, more stable counterparts continues and is not unusual given the length and strength of the previous trend. However, signs continue to point to a shift to more conservative characteristics since February as the new trend builds strength for a longer and more sustained period of outperformance. Additionally, the strength of these factors in the broader universe is a boost to the confirmation of this new trend.

Fixed Income Market

- As we head towards the end of 2021, many of the discussions within the bond market revolve around the future actions of the Federal Reserve and the path of quantitative easing. With continued support from the Federal Reserve and an unknown direction of interest rates, the performance of the Bloomberg Aggregate was relatively flat with a return of 0.05% for the quarter.

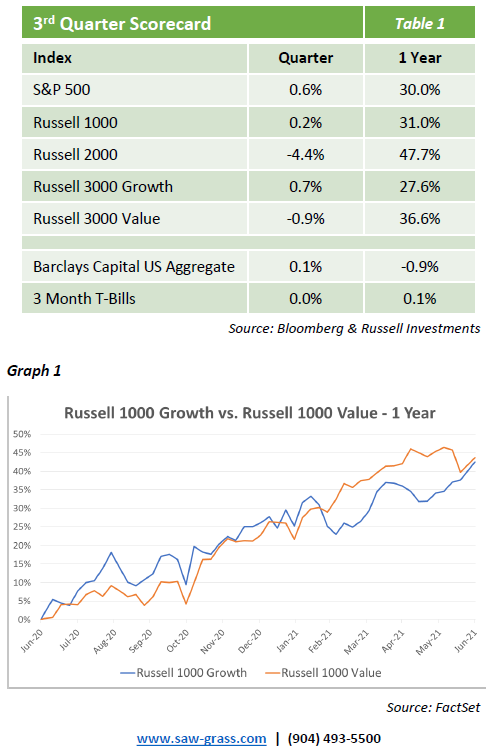

- Early in the pandemic, the Fed began purchasing $120bn worth of assets each month – $80bn in U.S. Treasuries and $40bn in mortgage-backed securities. These purchases have added more than $4trn to the Fed’s balance sheet (See Graph 2). Recently, with more comfortability regarding employment and inflation, the Fed has indicated they may begin tapering these monthly purchases by the end of the year. A complete removal or purchases may occur by the middle of 2022.

- If the Fed were to begin this tapering process, the next step in their monetary policy may be to raise interest rates. The Fed chairman, Jerome Powell, has been insistent that a rate hike should not be assumed as an immediate successor to tapering. However, recent forecasts by Fed officials indicate that more are predicting rate hikes to begin in 2022.

- Along with Fed officials, investors are also monitoring the effects of inflation and whether the price increases being seen are to be considered transitory or longer-lasting. The yield curve is indicating a more transitory nature of inflation with a flattening of interest rates. The 5yr and 10yr Treasury rates have increased 8bp and 2bps respectively while the 30yr was down 4bps (See Graph 3).

- Perhaps because of an expected rise in interest rates and volatility, corporations are issuing new debt at record levels. Despite the increased supply, spreads on investment grade corporate bonds were also flat for the quarter.

- Given the expected tapering and growth prospects, we are positioned to outperform if there is a corresponding increase in interest rates. Without a clear picture of monetary policy, we expect there to be further volatility in the upcoming quarters. Our active management should allow us to navigate around this volatility and take advantage of opportunities within the various asset classes of fixed income.

Opinions expressed herein are subject to change.