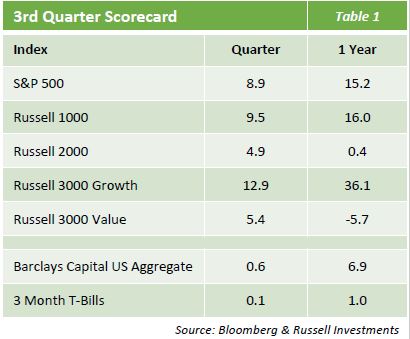

Equity Market: Quarter in Review

- The market surged to a 9% gain in the third quarter on electrifying returns from the tech sector and a steady current of low rates, positive economic news, and a record level of corporate earnings beats.

- July set the tone with the market closing at its first record high since the February peak, while August continued the pandemic recovery producing the second-highest monthly gain for the year with minimal volatility – only 5 days that month failed to produce gains.

- September’s nearly 4% loss rerouted the rally as investors began profit taking in large cap tech names and doubts arose about the sustainability of the economic recovery with Congress failing to agree on an additional stimulus package.

- Small cap stocks once again failed to keep pace with the price movement of large caps as the performance of the 5 largest index weights continued to dominate the production and trajectory of the market’s returns.

- This was particularly noticeable among the heavily weighted tech stocks as that sector’s performance alone made up over 35% of the S&P 500’s return, despite being outperformed by the Consumer Discretionary, Materials, and Industrial sectors.

- Growth and Momentum were predictably the strongest performing factors during the third quarter but Value stocks held up better in September outperforming Growth stocks on a monthly basis for the first time all year.

Equity Market: The Quarter Ahead

- It would be challenging to doubt the resilience of a market that has endured US-China trade tensions, US-Iran war tensions, continent-wide wildfires, a severe health pandemic, global economic shutdowns, recurring protests, a second round of wildfires, and simultaneous hurricane landfalls in just the first 9 months of the year.

- The market’s resilience will once again be tested with the upcoming presidential election, which has the potential to inject all kinds of uncertainty into the process of helping the economy recover from the lingering effects of the COVID pandemic.

- As September showed, there are limits to investor support for this year’s rally and any significant spikes in volatility could lead to mass profit-taking from the market’s largest gainers.

- With the current level of concentration in such a small number of stocks, selling pressure among these heavily weighted names could quickly accelerate into a market downturn that doesn’t have the safety net of a strong economy with robust corporate earnings growth.

- On the other hand, the Fed’s commitment to keep rates lower for longer provides an environment where growth companies will continue to be attractive to investors so a march higher through the end of 2020 is not an illogical assumption.

- Even so, it’s hard to imagine that the narrowness of this market is sustainable so the path higher will likely involve a rotation into other sectors (or styles) with all the requisite volatility that tends to follow such a move.

Fixed Income Market

- The third quarter of 2020 seemed to bring an eerie hush to the fixed income markets. After the heightened volatility seen in both Q1 and Q2, first from the initial impact of Covid-19 and then from the actions of the Federal Reserve, there was a certain calm after the storm. With the upcoming Presidential election in November, one wonders if this current calm is preceding yet another storm brewing on the horizon. Given the more muted market moves, the Barclays Aggregate produced a return of 0.62% for the quarter.

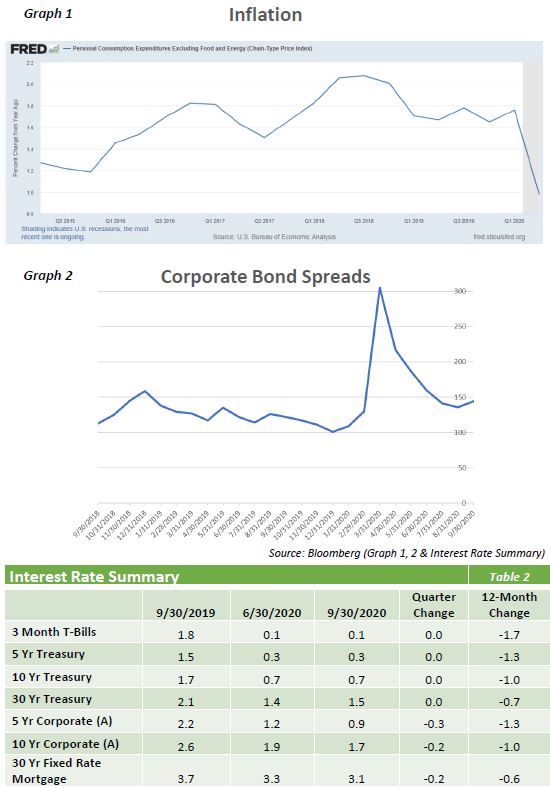

- Adding to the lower levels of volatility within interest rates was the Federal Reserve’s announcement of a revised framework for how they will approach monetary policy going forward. To further stress its commitment to growth, the Fed has vowed to keep rates lower for a longer time. Even given low unemployment, they will no longer pre-emptively tighten interest rates purely on the expectation of future inflation. With continued subdued inflation below target (Graph 1), the goal has been adjusted to now represent a longer-term average of 2%. This will allow inflation to run higher before considering a rate hike.

- Although there were intra-quarter movements, the U.S. Treasury market was mostly very quiet across the entire curve. The 10-Year Treasury was up only 3bps. There was a slight steepening of the curve as front-end rates remained down and longer-term rates moved up marginally.

- Early in the quarter, there was a continued tightening of spreads within corporate bonds. The effect of the Federal Reserve’s actions, including low rate commitments and corporate bond purchasing, was sustained throughout July and August. With spreads getting closer to pre-pandemic levels (Graph 2) and remaining concerns about the economic recovery, there was a slight widening of spreads as the quarter came to an end. Overall, investment-grade corporate bond spreads tightened by 16bps.

- As we head into the fourth quarter, it is hard to remember a time when so much uncertainty existed. The aforementioned election has the potential to produce large market movements given the uncertainty of the outcome. And that is before delving into the policy shifts that may occur afterwards. This, of course, is overlaid with the unknowns of Covid-19 and the timing of a potential vaccine. Until there is more clarity, returns across all asset classes will be prone to large swings, and we believe the value of a high-quality core fixed income portfolio will be further highlighted.

The opinions expressed herein are subject to change.