September 30, 2019

Volume 22; Issue 3

Equity Market: Quarter in Review

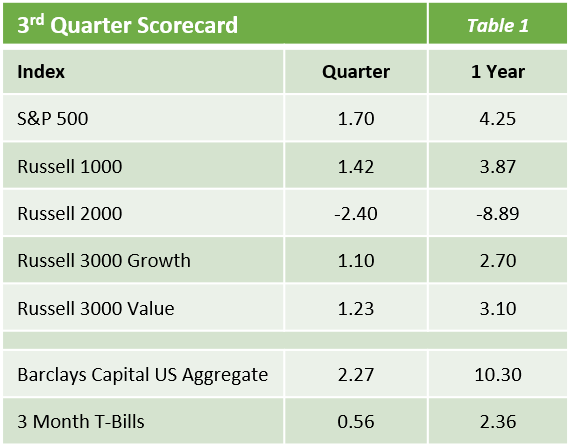

- Volatility continued to reign supreme in the market as the S&P 500 endured a rocky ride led by the familiar themes of US-China trade riffs and Fed rate cuts to post the 3rd positive quarter of the year, rising 1.7%.

- This quarter was a muted version of the previous three months as the market once again rose to start the quarter, only to decline, then again close the quarter higher on renewed optimism regarding the de-escalation of trade tensions.

- Growth stocks continued to lead value and large company stocks again led small company stocks.

- The falling rate environment helped defensive sectors such as Utilities, REITs, and Staples, which led performance among sectors, while weakness in biotech and geopolitical events weighed down Healthcare and Energy stocks.

Equity Market: The Quarter Ahead

- Despite a more modest gain during the quarter, the S&P 500 is still up an impressive 18.7% year to date, suggesting that investors continue to have optimism regarding the future of the economy heading into the final months of 2019.

- Consumer sentiment continues to be strong as unemployment remains low and wage growth has steadily risen; however, the macro environment is flashing caution lights from afar.

- Accommodative monetary policy throughout the globe suggests that most central banks are preparing for a future of lukewarm economic expansions (if any) and slowing corporate profit growth.

- It is noteworthy that stocks have experienced an extended period of volatility that began in Feb 2018. Since that time, we have had a decline of -12%, rally of 16%, decline of -20%, rally of 29%. The net result is a price gain of only 3.6% for the S&P 500 with ever-increasing volatility.

- With this increasing volatility in mind and the prospect of a slowing economy as signaled by a Fed willing to push interest rates near zero or lower, we believe it prudent that stock investors consider their risk profile in a serious manner.

- Though politics may dictate ever more accommodating policy as we approach an election year, in the end, real earnings growth is the fuel stocks need to move significantly higher.

Fixed Income Market

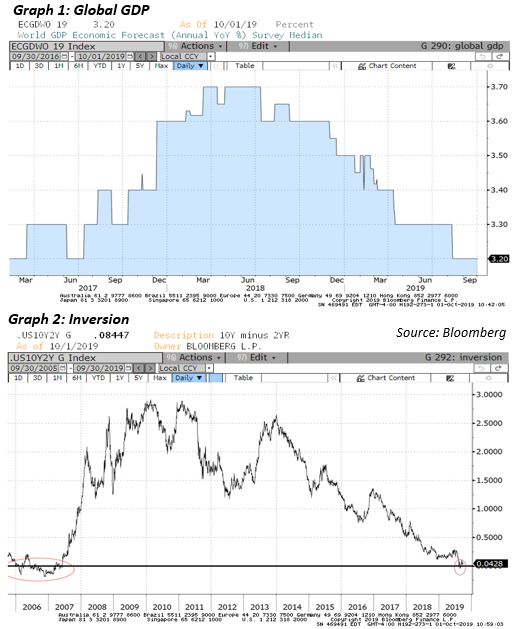

- Throughout the 3rd quarter, investors showed signs of growing increasingly fearful of a global recession. Economies are slowing around the world, buoyed by the uncertainty amid escalating trade tensions. Global Central Banks have been taking actions to loosen monetary policy in an attempt to stave off recessions, but a low growth environment appears to be the base case scenario going forward (graph 1).

- Domestically, the Federal Reserve cut rates by another 25bps during their September meeting, following up on a prior 25bps cut in July. The cut was fully expected by the market and the more important question at this point is what the next steps for the Fed will be. The uncertainty regarding the path forward is supported by the divided opinions reflected amongst the Fed Governors. At the September meeting, one member voted for a 50bp cut while two voted for no cut. Forecasting out, seven members projected another 25bp rate cut by the end of this year, while five currently prefer to hold rates steady. All the while, the President continues to outwardly criticize the Fed as he calls for lower rates and even insinuated that negative rates in the U.S. could be beneficial.

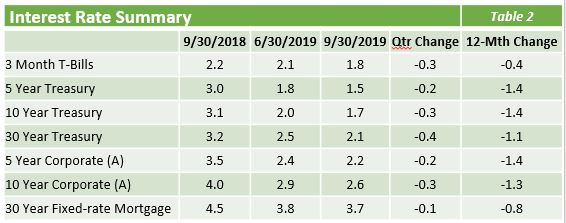

- Amidst this indecision, rates have continued to come down across the Treasury curve with the 10 year Treasury breaking below 2% yet again, down 34bps to 1.67%. Over the last year, the 10 year has come down 140bps, further reinforcing the bearish economic outlook of the bond market. In March, the spread between the 3 month and 10 Year inverted for the first time in 12 years. While some believed such an inversion was a harbinger of a recession, many pointed to the spread between the 2 year and 10 Year as the more accurate predictor of future recession. Up to that point, this spread had yet to invert. That changed in August as the 2/10s spread inverted for the first time since December 2005 (graph 2). While the inversion only lasted for a week, this particular spread inversion has preceded every recession over the past 50 years with the occurrence of a contraction coming 22 months on average following such an inversion.

- The continued downward movement in rates has aided in the performance of bond products as the Barclays Aggregate gained 2.3% for the quarter and has been up 10.3% over the last year. For the quarter, duration was the key component of return as corporate bond spreads were flat. Both economic and political risks remain. This added uncertainty breeds further volatility, which breeds opportunities. We believe the market will continue to shift and plan to maintain a nimble portfolio, continuing to outperform.

The opinions expressed herein are subject to change. Please contact us for further details at 904-493-5500.