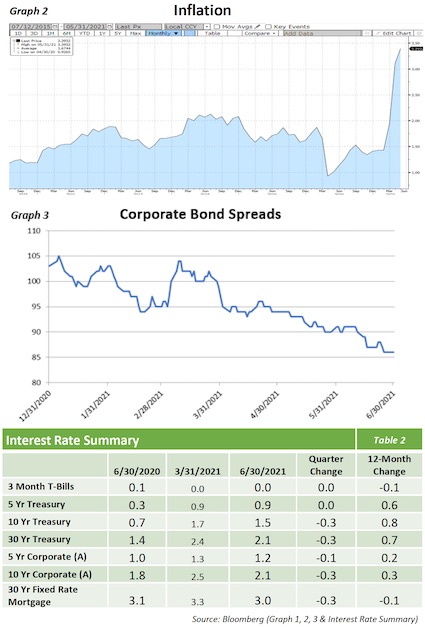

Equity Market: Quarter in Review

- The U.S equity markets rallied in Q2 with the S&P posting a gain 8.2%. This mark edits fifth straight quarterly gain in the wake of the 20% pull back in Q1 of 2020

- Megacap stocks (MSFT,AAPL,GOOGL,FB,AMZN) all posted double-digit returns for the quarter after lagging the rest of the market as a group for the previous two quarters

- Many of the same bullish themes such as fiscal stimulus, vaccine progress, reopening momentum, strong corporate profit backdrop, and equity inflows that led the market in the first quarter continued to be in focus in Q2.

- Inflation was the most important and complicated macro theme in Q2. The Fed remained consistent in its messaging around expectation that price pressures will be transitory. This, along with easing interest rates, helped growth and momentum stocks outperform value and cyclicals for the quarter.

- With the exception of Utilities (-1.13%), all sectors produced positive returns for the quarter. REIT’s, Information Technology, and Communication Services led; while Utilities, Consumer Staples, and Industrials lagged.

Equity Market: The Quarter Ahead

- The S&P 500, with a gain of 15.25% this year, has posted its second-best performance since the dotcom bubble. However, several concerns persist such as stretched valuations, the potential for an inflation overshoot, margin pressures, tax increases, and coronavirus variants.

- There is a lot of debate about what may happen next in the battle of value vs. growth. As inflation, reflation, and reopening remain in focus; we could continue to see a rotation from growth into value

- There has been a continued back and forth between the old trend of higher valuation, riskier characteristics and the new trend favoring lower valuation and more stable characteristics. This is not unusual given the still early nature of this shift.

- However, the overall move in the direction of the new trend will likely begin to become more entrenched as the year goes along especially with any significant equity market weakness likely accelerating this shift.

- The nature of these shifts tends to play out over a multi-year time period with the current environment likely only the beginning of this significant change in leadership.However, the environment for this change is still fraught with the tug of war between what has worked so well for the last 2-3 years and what appears to be poised to work over the next multi-year period.

Fixed Income Market

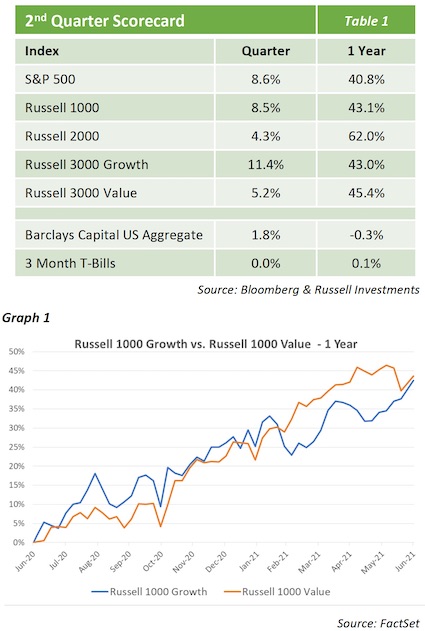

- Coming off a historically poor 1st quarter of performance, the Barclays Aggregate bounced back with a return of +1.67%. The inflation story continues to drive the markets as questions linger over whether the current measures will prove to be transitory or longer lasting (Graph2).

- The response of the Fed strongly influenced the direction of the U.S. Treasury Curve throughout the 2nd quarter. While the Fed insists that their belief lends to the transitory nature of current inflation, there has been a slight hawkish sentiment in their language most recently. The most recent forecast from Federal Reserve officials suggest two rate hikes in 2023, sooner than previous forecasts.

- The hawkish statements from the Fed caused an overall flattening on the Treasury Curve, which was the largest driver of returns for the quarter. The front-end of the curve, which has barely budged since the beginning of the pandemic, started to inch up. The 2-year was up 10bps while the 10-year and 30-year were both down 25bps and 30bps respectively.

- Corporate bond spreads continued to compress and were tighter by 6bps (Graph3). At a current spread of only 88bps, corporate bond spreads are now below their pre-pandemic levels. As has been the case since the Fed took steps to secure the corporate bond market last Spring, the lower quality segment of the investment grade universe continued to outperform.

- As the country and world continue to recover from the effects of the pandemic, the path of economic improvement will be closely monitored. With the beginning of the summer starting and lockdowns dissipating, there is a sense of renewed optimism. But this is being tempered by the risks of inflation.

- With this uncertainly regarding the track of growth, we expect further volatility in bond markets. As always, will search for the best relative opportunities with an emphasis on risk controls.

Opinions expressed herein are subject to change.