Equity Market: Quarter in Review

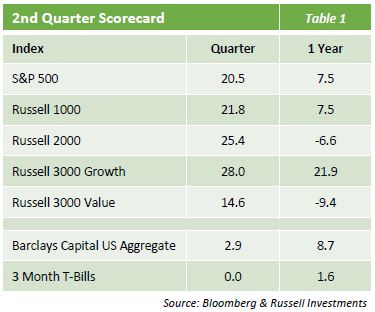

- The second quarter came and went without a Coronavirus vaccine, but stimulus packages from the Fed and Congress turned out to be the cure for an ailing stock market as the S&P soared over 20% to produce its strongest quarterly gain in 21 years.

- Most of the gains occurred during the first two months of the quarter as April’s strong 13% returns elongated the bounce off the market lows in March and a further 5% rise in May solidified the V-shape recovery in stocks.

- The move higher this quarter was more textbook-like as small cap stocks vastly outperformed large caps (Russell 2000 +25%), and the best performing factor groups were high beta, growth, and momentum stocks while low-volatility stocks lagged most.

- Fed Chair Powell’s insistence that the Fed has both the intentions and capability to support the economic recovery gave investors confidence to rally the market despite little visibility on corporate earnings growth, historically high unemployment, and still weak retail sales numbers.

- Optimism around potential vaccines and the re-opening of most state economies also helped boost the market early on in the quarter while the FOMO (fear of missing out) trade likely propelled stocks throughout May and June even as COVID cases began to rise.

- Large cap tech stocks continued their dominance for the year as the Nasdaq rose 31% in 3 months led by persistently stellar price appreciation in index giants Apple, Microsoft, Amazon and Facebook.

Equity Market:The Quarter Ahead

- While a 20% rise in one quarter is an amazing feat, the market has yet to break even for the year and has significant room to go before it eclipses the mid-February peak.

- As momentum from the rebound rally begins to fade, investors will be faced with unresolved non-COVID related issues that may bring uncertainty and its tangible byproduct, volatility, back to the forefront of the trading floor (or rather trading apps).

- Simmering US-China tensions, the threat of post-election tax reform, Congressional spats over future stimulus packages, and potential state closures are just some of the many issues that investors could struggle with in determining whether the market continues to present attractive opportunities.

- The bull case for the market from this point is that negative Coronavirus impacts are already priced in and investors will rally behind any exceeded expectations as evidenced by recent positive reactions to better than expected (but still weak) jobs data and retail sales numbers.

- With the Fed’s pledged support and vast room for economic improvement, the path of least resistance for the market seems to be higher but the enduring COVID pandemic could produce enough detours to direct the market back on a downhill path.

Fixed Income Market

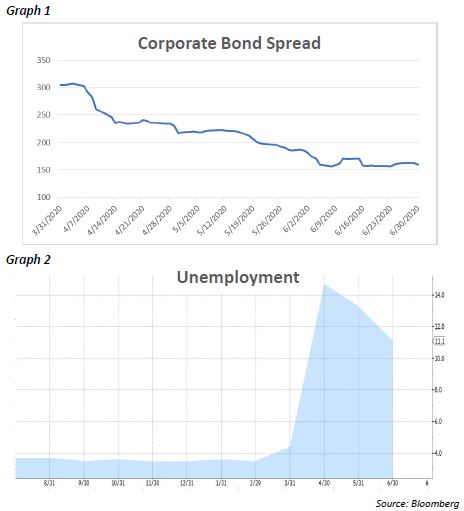

- The second quarter proved to be a battle between the effects of COVID-19 and the steps that were taken to try and minimize the damage, in both monetary and fiscal policy terms. Towards the end of the first quarter, the actions to unfreeze the credit markets had a substantial effect in bringing some normalcy back to markets. This trend continued into April and beyond. From an economic standpoint, the quarter included an unprecedented job loss of 19.5 million in April, followed up by a surprising gain of 2.5 million in May. The wild swings in the labor market were emblematic of the overall muddled picture of an economy in flux.

- Even with low yields brought on by a prior flight to quality in the first quarter, the Barclays Aggregate still returned 2.90% for the second quarter. Most of the performance can be attributed to the corporate bond space as the investment grade corporate bond index tightened by 145bps (Graph 1).

- Coming off the widest levels seen in late March, this drastic move in spreads was led by a combination of optimism and the Federal Reserve announcing they would be buying investment grade corporate bonds for the first time in history. A total of $750B has been allocated to create an index of bonds with maturities of five years and less and that meet other criteria of high grade issuers. This bond purchase program and the Fed’s mantra to “do whatever it takes” seems to have provided a floor for most risk assets.

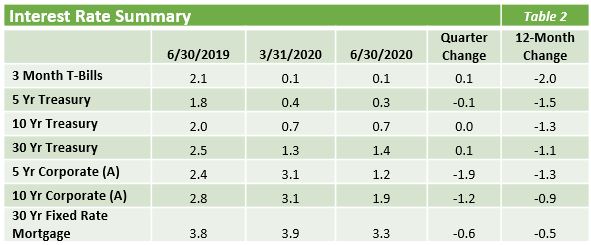

- Interest rates have remained somewhat stable amidst the uncertainty, partially due to the Federal Reserve stating that their target rate will be zero for the foreseeable future. Prior periods that reflected a mostly flat curve, and even an inversion in the 2 year/10 year Treasury curve last August, have made way for a steady steepening of the yield curve on the hope that the economy has come off its low point.

- As we head into the second half of the 2020, virus concerns endure, and the unemployment rate remains historically high at 13.3% (Graph 2). The most optimistic outlook of a direct V-shaped recovery appears unlikely. While the Federal Reserve has shown a dedication to keeping the economy afloat, future shutdowns could prove to be significant deterrents to growth. Amidst this uncertainty, we expect further volatility until there is a semblance of clarity on how the economy can handle COVID-19.