June 30, 2018

Volume 21; Issue 2

Stock Market: Quarter In Review

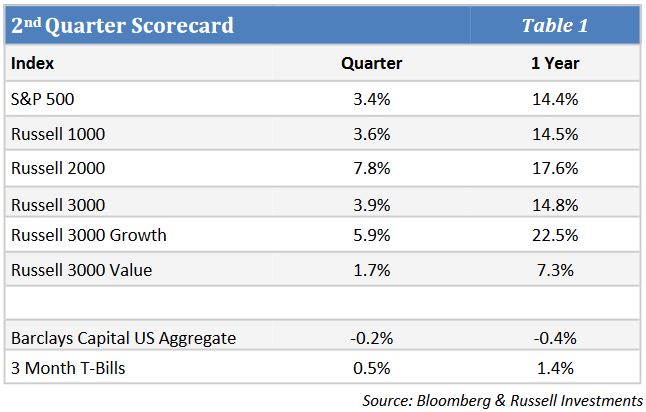

- The equity markets rebounded in the second quarter after the first bout of volatility in almost two years brought the health of the bull market into question. A steady move higher led by small caps and momentum oriented names in large cap were indications that risk seeking is still the market’s current path to gains.

- Despite numerous headlines and concerns about political issues and trade policies, the major indices moved steadily higher and registered the solid, low volatility gains that have been characteristic of this portion of the cycle.

- The concentration of index returns in a small number of large, heavily weighted companies and their overwhelming effect on the contribution of return in the large cap indices continued in the quarter.

- Small outperformed large and growth once again handily outpaced value as the top sector performers were energy, consumer discretionary, and information technology while the relative laggards were consumer staples, industrials, and financials.

Stock Market: The Quarter Ahead

Stock Market: The Quarter Ahead

- The markets enter the balance of the year in a holding pattern as the major indices work through the gains of the past couple of years. This pause will likely turn out to be a short-term consolidation before heading higher in a more meaningful way or may be part of a larger topping process before a more significant correction.

- Economic and earnings growth have improved from once tepid levels helping justify some of the multiple expansion that occurred over the past couple of years. The one-time bump from the recent tax cut will make for tougher comparisons going forward.

- Valuation multiples remain elevated despite the current earnings growth rates leaving little room for disappointment going forward. The recent trend toward higher interest rates will make these valuations even less attractive if rates continue to climb.

- Small cap leadership and the lack of significant long term resistance levels in the major large cap indices leave the markets with the potential to continue higher in the short to intermediate term.

- Political uncertainty and less well defined fiscal and trade policies remain concerns despite the ability of equities to shrug off these issues.

- The continued focus on momentum and what is working currently leaves the markets vulnerable once sentiment shifts from risk seeking to capital preservation. Given how far participants have reached for risk during this bull cycle, the reaction towards safety could be greater than most investors currently anticipate.

- Despite the continued strength in the major indices and the focus on a handful of momentum oriented stocks, risks remain higher than normal at this stage of the cycle and a shift to more stable growth characteristics should be expected given past precedent.

Fixed Income Markets

- The post-recession era can be defined as a period in which many areas of the developed world were aligned together in steady growth. Much of this economic strength was tied to a similar stance of global Central Banks, many of whom provided fuel to their respective economies via various forms of quantitative easing. But signs of a divide have recently become more present and this global synchronization may now be sputtering.

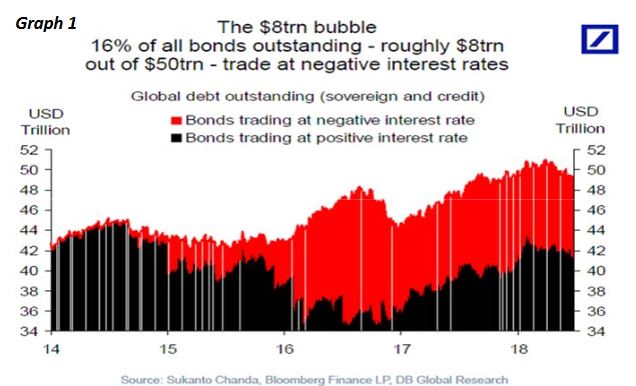

- While the U.S. Federal Reserve has felt comfortable enough in the strength of the domestic economy to tighten monetary policy by raising interest rates and reducing their balance sheet, this sentiment has not yet been replicated in other areas of the world. The European Central Bank, for example, has seen a lagging economy and, up until recently, had been hesitant to end its own massive bond-purchasing program and has not yet increased interest rates. There are currently approximately $8trn of bonds (sovereign and credit) globally that trade at negative interest rates, whereas there were none in 2014 (Graph 1). Yields were up across the curve but it was not a quarter without trepidation. After peaking at 3.11% in May, the 10 year Treasury yield dipped down to 2.78%, ending the quarter up modestly at 2.86%.

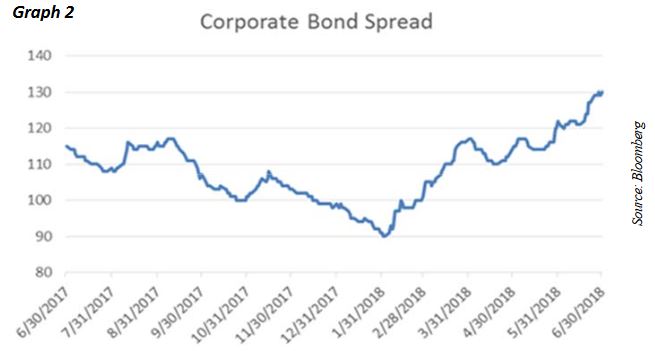

- This global division is not isolated to the behavior of the Central Banks as the fear of a trade war escalation continues to weigh on markets. What was once considered rhetoric to drive world leaders to the bargaining table has become more of a reality as both tariffs issued by the U.S., as well as retaliatory tariffs from other countries, are starting to take effect. It remains unclear what effect this will have on global growth. While markets initially brushed the trade war risks aside, recent developments involving the enactment of tariffs and the unknown geopolitical effects of various global elections have started to be reflected in asset prices. Investment grade corporate spreads widened on the quarter by 13bps and have now widened out by 31bps for the year (Graph 2). The volatility in corporate spreads has only been elevated by factors such as high levels of corporate bond supply and M&A risk.

- It is clear that there are many obstacles facing both the economy and markets going forward, which include numerous potential outcomes. Despite these risks, we believe that the Federal Reserve will continue to raise interest rates as the domestic economy has remained resilient and we plan to mitigate the aforementioned risks by owning higher quality corporate bonds that can weather bouts of volatility we may face in the future.

The opinions expressed herein are subject to change. Please contact us for further details at 904-493-5500.