Equity Market: Quarter in Review

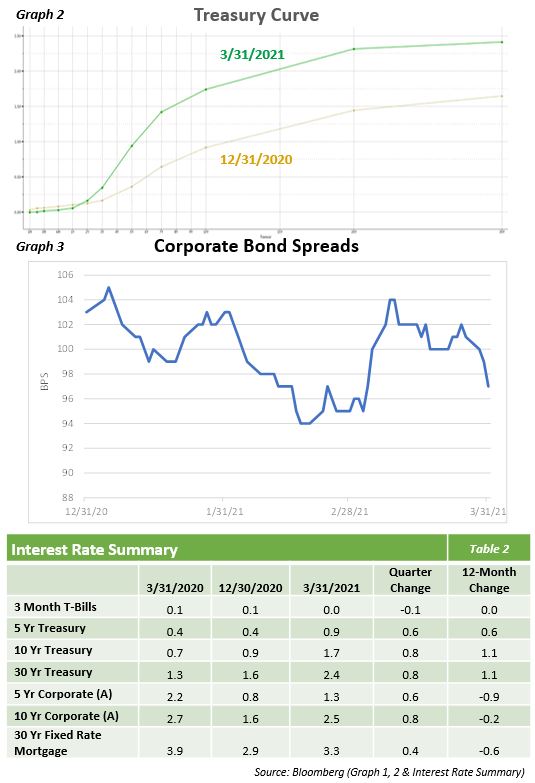

- The U.S equity market ended the first quarter on a strong note with the S&P 500 posting a gain of 6%, driven by fiscal and monetary stimulus and continued optimism from COVID-19 vaccines.

- The markets had continued to generally favor higher growth, more speculative companies through the middle of February. However, the strong and persistent rise in rates was a major contributor to equity market participants finally acknowledging concerns about “long duration” growth stocks’ stretched valuation multiples. The resulting outflow of capital from many of these higher valuation mega caps stocks likely found its way into more attractively valued names.

- In a reversal of the trend we have seen over the last couple of years, small caps outperformed large caps with the S&P Small Cap 600 up 18%.

- All sectors posted a gain for the quarter with Energy strongly outpacing all sectors, up 31%. Financials and Industrials also posted double digit returns while last year’s leader, Information Technology, was the second worst performer in the quarter.

- High Beta was the strongest performing factor for the quarter, with the value factor also posting strong returns. In a reversal from what we have seen over the last year, growth and momentum were the two worst performing factors.

Equity Market: The Quarter Ahead

- Despite a great deal of uncertainty entering 2021 surrounding the trajectory of the Coronavirus as well as a new presidential administration, a bullish narrative persisted during the first quarter.

- Investors have continued to focus on positive themes such as the stimulus package passed in the quarter as well as the coronavirus vaccine rollout gaining momentum. However, potential risks do exist including companies meeting increasing earnings growth expectations, new coronavirus variants, the potential for higher taxes, and margin pressures from higher input costs.

- The shift from concentrated to broad market leadership (Graph 1) and an increased appetite for attractive valuations gained traction this quarter. The strength behind some of the quantitative signals suggests that these trends likely have a long way to go.

- Given the extremes of the past 2 years, a correction back to more normal historical relationships could be stronger and more persistent than many investors anticipate.

- Investor sentiment is currently very optimistic concerning continued expansion with the reopening of the economy and ongoing Federal Reserve accommodation leaves the markets fully priced. Much of this positive sentiment has seemingly been discounted given the sharp rise in equity prices over the past year leaving further gains likely to be moderate at best over the remainder of the year.

Fixed Income Market

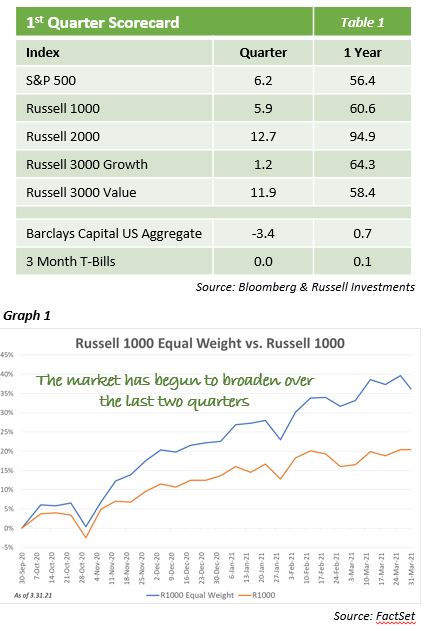

- Contrary to recent quarters of quiet movements in interest rates, the 1st quarter presented a tremendous amount of volatility. The prospects of future growth and inflation, spurred on by the vaccine rollout and a $1.9 trillion stimulus package, drove parts of the Treasury curve higher.

- While the zero to two-year part of the Treasury curve was generally flat, the five-year and longer section of the curve exhibited a large steepening with the five-year up 58ps and the thirty-year up 77bps (Graph 2). To put the sell-off into context, the 10+ year section of the yield curve had a total return of -13.24% for the quarter.

- The movement in the Treasury curve accounted for the majority of performance in Q1 as corporate bond spreads tightened by 4bps (Graph 3). The current level of tight spreads, balanced with a positive economic outlook, dampened the range of corporate bond spread movements.

- Based primarily on the sell-off in Treasury rates, the Bloomberg Barclays Aggregate return of -3.37% was the worst quarterly performance since 1981. After two years of high absolute returns, we did expect a period of low returns as we entered 2021 but the magnitude of the movement in rates was more severe than anticipated.

- Given the fiscal spending and economic recovery coming off the depths of the impacts felt from COVID-19, the fears of an overheated economy and inflation are real. The main question regarding inflation in the current environment is whether the inflation prints will be temporary or if they are part of a longer trend of rising prices. Coming off the depths of the COVID-19 effect on the economy, some of the economic numbers that will been seen in future quarters will be larger than what we have seen recently. Similar to the inflation concerns, investors will have to weigh if these numbers are part of a base-effect or are the beginning of a sustained period of high growth.

- These market conditions present risks for the potential of further rising rates. If this scenario unfolds, we will continue to monitor and position the portfolio to protect principal before further opportunities present themselves.

Opinions expressed herein are subject to change.