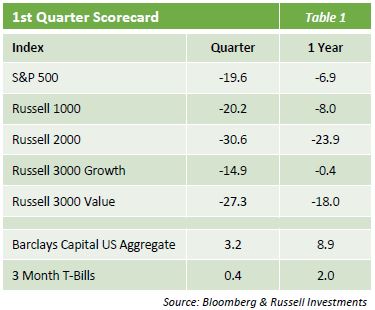

Equity Market: Quarter in Review

- After a decade of clearing multiple hurdles with ease, the racing bull market tripped and suffered a career-ending injury as the market declined 35% before rebounding to finish the first quarter of 2020 down 20%.

- The market’s decline was notable as it occurred swiftly and in an uncharacteristic fashion – the first two weeks of the pullback saw the highly-valued bull-market-leading technology sector hold up better than all except the bond-proxy utility stocks.

- Despite multiple Fed interventions and a nearly unanimous bi-partisan agreement on a stimulus bill, investors couldn’t shake off the devastating effects of the global shutdown caused by the growing Covid-19 pandemic and sold off stocks in an indiscriminate and extremely volatile manner.

- With four daily market moves above 9% (two positive, two negative), volatility reached levels not seen since the financial crisis of 2008, and the historic collapse of oil prices certainly helped contribute to the average 5% daily moves seen in the last month of the quarter.

- Large cap stocks were the least pummeled as the ever-increasing lockdowns that were enforced to help slow the spread of the Coronavirus hammered away at investors’ confidence that the more economically sensitive small and mid cap stocks could provide any sort of predictable earnings growth in the near term.

Equity Market: The Quarter Ahead

- Incomplete trade deals, indecisive Fed policy, upcoming elections…these were the issues widely seen as the likely cause for rising levels of volatility entering into 2020 and the 11th year of the bull market.

- Covid-19 has pushed all of these concerns to the background as investors juggle dealing with constant streams of hypothetical information and the realities of living in a quarantined world, where limited contact has lowered business prospects for the majority of industries.

- Though there could be small market bounces in the near term, until there is a global slowdown in the number of new Coronavirus cases, it is logical to expect the market to continue its downward trajectory without any signs of certainty to serve as the optimistic foundation for bullish trading.

- Opportunities for investors are likely to be thematic going forward – industries that connect people with other employees, businesses, or services could have the most potential for gains (or less punishment) until clarity returns to the business world.

- With both the business and political worlds focused on Covid-19, a market rebound could occur later in the year as a result of these groups’ collective efforts, but volatility levels are likely to remain elevated as issues placed on the backburner regain investor attention.

Fixed Income Market

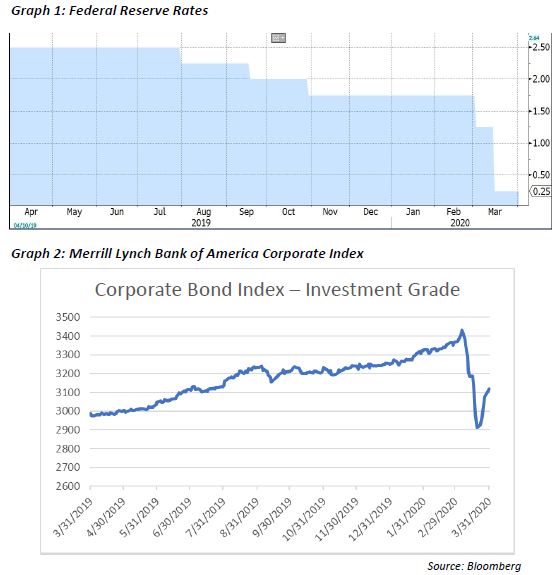

- In recent periods, we have talked about the markets appearing to take a wait-and-see approach before deciding on what direction to take. In the first quarter, it became clear that market participants decided to wait no longer as the effects of the Covid-19 virus across the globe became more apparent. The magnitude of the impact across all asset classes and global economies was truly historic in nature. Also unprecedented were the swiftness and size of both monetary and fiscal policy packages put into place. Fortunately, through the severe volatility, Investment-grade bonds were able to act as a buffer in many portfolios as the Barclays Aggregate returned +3.15%.

- The Federal Reserve first stepped up with an emergency rate cut of 50bps, followed quickly by another cut of 100bps only two weeks later (Graph 1). Those rate cuts were only the beginning of various Fed actions to ensure it does everything in its power to prevent a major credit crisis. Other steps taken include unlimited Treasury and MBS buying, two lending facilities to large companies, the ability to purchase corporate bonds and ETFs, Commercial Paper/Loan facility expansion, and an expected lending facility for small businesses. These monetary policy actions are in addition to the fiscal policy stimulus package of $2 trillion to help keep the economy afloat.

- The enormous rally in Treasuries across the curve was indicative of a full-blown risk-off scenario. Since year-end, the 10-year Treasury has come down 125bps with volatility not seen since 2008. With the 2-year Treasury as low as 0.23%, the prospect of negative interest rates and what those implications may be has become a real conversation. With the existing global economic concerns and a Fed backstop, a prolonged low interest rate environment looks to be the norm for the foreseeable future.

- Corporate bonds were not immune to the sell-off across asset classes as the ICE BofA Corporate Bond Index returned -4.05% for the quarter (Graph 2). As is typically the case in such a volatile period, correlations tend to converge and high-quality liquid bonds were not exempt from the pain. Prior to Fed actions, access to the credit markets was essentially closed off, which caused a major concern for the ability of both corporations and consumers to borrow.

- There have been recent signs of stabilization in the corporate bond space and we believe there will be further opportunities to invest in stable, well-capitalized companies at attractive spreads. Further volatility is expected but, as is part of our standard investment process, we plan to focus on the best opportunities with a strict adherence to risk controls in this new environment.

The opinions expressed herein are subject to change.

The opinions expressed herein are subject to change.