March 31, 2019

Volume 22; Issue 1

Equity Market: Quarter in Review

- The stock market celebrated the 10th anniversary of the current bull rally by charging 13.7% higher – its strongest quarterly performance since 2009 and the best first quarter gain for the S&P 500 since 1998.

- The anniversary party was well attended as investors in stocks of all sizes, regions, investment styles, and factor tilts enjoyed double-digit returns and the rising tide even lifted bonds significantly higher for the quarter.

- Nearly all of last quarter’s losses were erased and the market moved within a stone’s throw of its all-time high as the appearance of more amicable US-China trade talks and the Fed’s willingness to halt its pace of rate increases gave investors confidence that market shocks could be more muted going forward.

- Despite such a strong start to 2019, it should be noted that most of the S&P’s performance occurred in the first two months of the year and March’s more modest 1.8% gain could be an indicator that momentum is starting to dwindle.

- All sectors earned positive gains for the period with Technology and Energy stocks registering the strongest performance while the Financial and Healthcare sectors were the only groups that failed to earn double-digit returns.

Equity Market: The Quarter Ahead

- Even if the market finishes the year in positive territory, it’s doubtful this rally will continue at its current pace (65+% annualized return!) as investors may look for opportunities to take profits after such a strong advance to start the year.

- The contradiction of falling yields and rising stock prices will have to rectify itself in order for the market to give a clearer signal of its growth trajectory which means market fundamentals will be watched much more closely over the next quarter.

- This earnings season, the first one since 2016 that’s projected to see earnings decline, could become a stumbling block to the continuation of this bull market if disappointing results stoke fears that the US economy is slowing.

- Despite the ominous recession signal flashed by last month’s yield curve inversion, the US economy is widely seen as the most steady of the major global economies which could spur demand for US stocks from international investors.

- The completion of a US-China trade agreement might be a significant catalyst for market growth as it could stimulate the global economy and produce optimistic future corporate earnings projections.

- Until then, the market is likely to experience increased volatility as investors struggle to determine if this rally has the fundamental foundation necessary to grind higher.

Fixed Income Market

- If one harkens all the way back to our fourth quarter 2018 write up, it was stated that the markets can be very fickle. Further proof of this point was exhibited throughout the first quarter of 2019. The quarter displayed a large divergence in the performance of various assets classes as volatility continued, showing no signs of slowing down. These sometimes-conflicting indicators, particularly the yield curve moving down while the stock market rallies, are evidence that investors remain confused about the future of the overall outlook for both the U.S. and global economies.

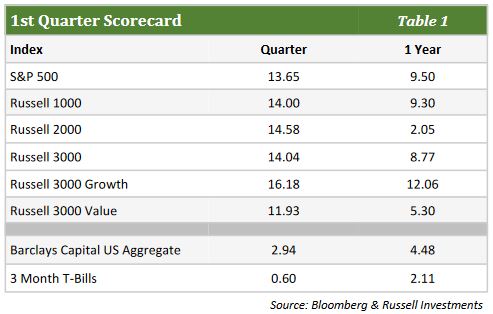

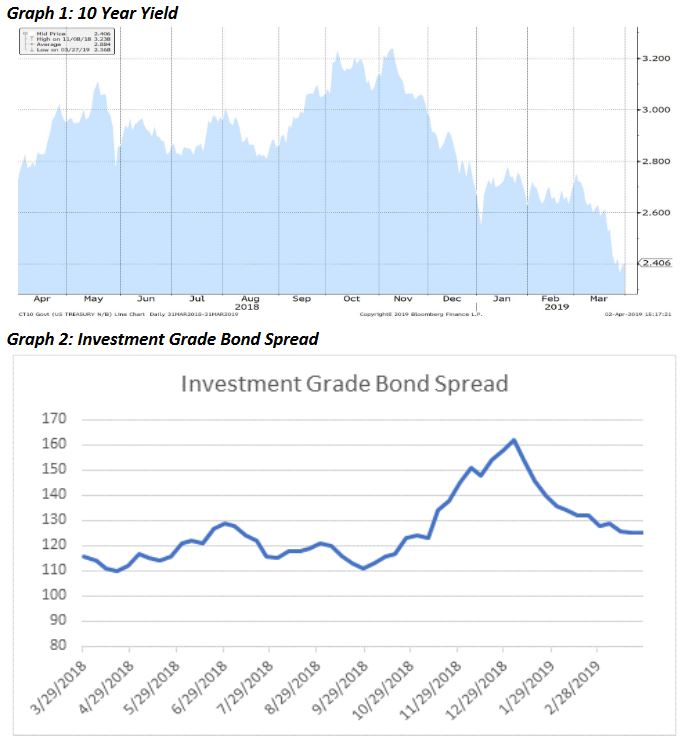

- Concerns about long-term economic growth and inflation have caused bond investor’s flight-to-quality by adding longer-dated treasuries, therefore pushing down those yields. Such action, coupled with past fed rate hikes increasing yields on the front end of the treasury curve, caused the 10-year yield to dip below the 3-month yield late in March. This is the first occurrence of that inversion since mid-2007. In the past, such an inversion has been a reliable indicator of a recession. In fact, inversions of that spread have preceded each of the past seven recessions. This fear of a slowdown caused the 10-year yield to decrease 28bps to end the quarter at 2.41%, a steep reversal from the recent high of 3.24% on November 8th, 2018 (graph 1). Overseas investors, concerned by their countries prospects and low interest rates, have pushed into U.S. corporate debt which has helped fuel a rally in the asset class. Spread in investment grade bonds tightened by 32bps on the year (graph 2), reversing the risk-off widening seen in the fourth quarter of 2018.

- These economic concerns, both domestic and global, have caused the Federal Reserve to take a more dovish stance and pause on raising interest rates any further. While previously expecting at least one further rate hike, the markets are now pricing in zero rate hikes for 2019 and are projecting an over 50% chance of a rate cut by the Federal Reserve. This looser stance on monetary policy can have the effect of boosting stock returns but can also inject additional worries about the U.S. economy and have an adverse impact on markets. The dovish stance, along with other factors such as the end of the government shutdown, did assist in a bounce back from the correction seen in the fourth quarter in the stock market as the S&P 500 was up 13.65% for the first quarter.

- Even though a yield curve inversion has historically been a good predictor of recessions in past periods, the timing or certainty of such a slowdown is still an unknown. What is more certain is that there will continue to be increased volatility as investors attempt to decipher any indicators that will help gauge the overall health of the economy. As that progresses and any dislocations become present in the market, we should be able to focus on investing on profitable opportunities within your portfolio.

The opinions expressed herein are subject to change. Please contact us for further details at 904-493-5500.