March 31, 2018

Volume 21; Issue 1

Stock Market: Quarter In Review

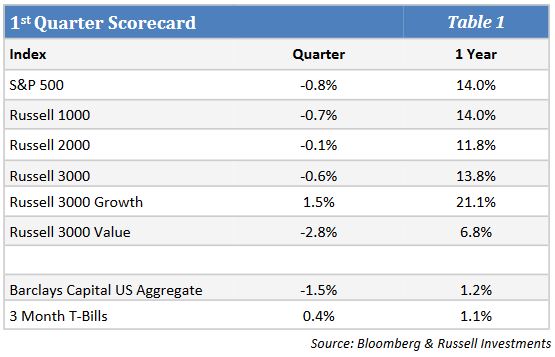

- The stock market experienced its first meaningful volatility in two years as early February brought an S&P 500 decline of 10% from the January highs followed by a rally into early March and then another 7% decline in March. Despite these two declines, the S&P 500 posted only a marginal negative return for the quarter of -0.8%. While investors have been concerned by the recent pullback, it is noteworthy that this is only the second negative quarter in the last five years, a period of calm which does not often happen.

- Despite the volatility, leadership remained unchanged as Growth stocks continued to lead Value stocks by a significant margin. Smaller stocks were slightly better than large. Sector leadership has been consistent for some time as Technology and Discretionary stocks continued their leadership. It was notable that Staples and Utilities were some of the most negative for the quarter as these usually defensive sectors were perhaps impacted by rising interest rates.

- The market continued to have a risky tone. From a factor perspective, high momentum was strongest while favorable valuation was the weakest. This was also evident in some of the riskier leadership. While Facebook stumbled, Amazon, Netflix, and Adobe all posted returns of 20% or more for the quarter.

Stock Market: The Quarter Ahead

- The recent surge in volatility leaves open the question of whether the markets have reached a significant area of resistance that will cause the markets to digest or give back even more of the gains of the last 16 months.

- Earnings growth has improved from its once languid pace and is set to see a one-time boost from lower corporate tax rates in coming quarters.

- At current levels, valuations remain stretched leaving markets with little room for disappointment. Earnings growth will likely need to continue to outpace expectations to justify current multiples once the effect of the tax cuts has passed.

- The recent relative weakness in the momentum-oriented names that have led to the upside is a possible harbinger of more substantial corrective action going forward.

- Domestic and international political risks remain substantial unknowns and increase the potential for more volatility in the months ahead.

- At least for this quarter, the trajectory of the stock market shifted. This is the first real hesitation in two years. What is not clear is whether this is just a pause in a nine year bull market which has risen almost 350% or the beginnings of a longer topping process.

- In either case, given above average valuations and rising interest rates, stock returns are likely to be more modest and in sync with earnings growth than the outsized returns we have seen for the last nine years (S&P 500 16.7%/year).

Fixed Income Markets

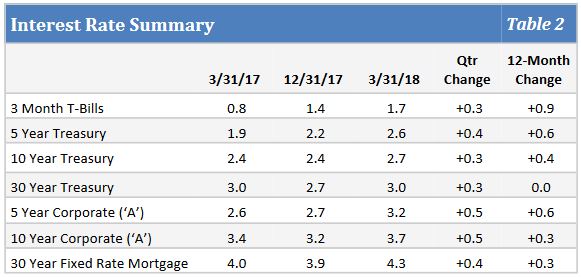

- As we entered the New Year, investors kept the party going with the glee from tax reform legislation showing no signs of slowing down. It appeared as if risk assets could do no wrong with the S&P 500 up +7.5% through January 26. However, the first stumble of the year was felt after higher than expected inflation numbers and wage growth continuation (Graph 1) were reported and the fear of a quicker pace of rising interest rates caused equity markets and corporate bond spreads to negatively react. This correction turned out to be short-lived as investors seemed to brush this risk aside with equity markets driving higher after less than two weeks of trending negative.

- That renewed volatility was to serve only as a precursor to what would unfold in March as issues affecting global growth prospects began to surface. In addition to pre-announced tariffs on steel and aluminum from China, the Trump administration announced further restrictions on investments and additional tariffs on $60B worth of products. While the eventual impact of these tariffs is unknown, the uncertainty surrounding further steps taken by the administration as well as ramifications on economic growth due to retaliation by affected countries spooked the global markets and asset prices reacted accordingly. The last week of first quarter ended with a trend of decreasing bond yields as the risk-off sentiment returned.

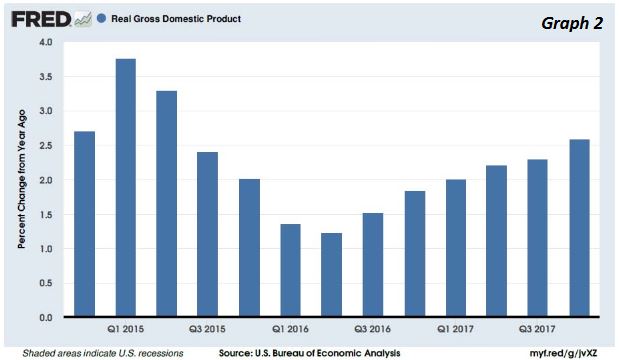

- The safe haven of bonds was also not to be as rising interest rates paired with widening corporate bond spreads to produce a -1.46% drop in the Barclays Aggregate for the quarter. Countering some of the recent volatility is the backdrop of a mostly benign economic environment with growing corporate profits and GDP that has trended upwards (Graph 2) with the potential of more upside given further effects of tax reform and remaining low absolute bond yields. Whether this recent downturn is a temporary impediment or if it is indicative of valid fears concerning global growth slowdown will be something to monitor for the rest of the year.

The opinions expressed herein are subject to change. Please contact us for further details at 904-493-5500.